Introduction :

Global financial markets are once again on edge as the United States, China under former President Donald Trump’s influence, has announced a steep 104% tariff on Chinese goods. This move, reportedly effective from midnight Wednesday, comes just a day after Trump demanded that Beijing roll back its 34% retaliatory tariffs. The decision, which adds an extra 50% duty on top of existing tariffs, marks a sharp escalation in U.S.-China trade tensions.

While Indian markets closed higher on Tuesday, bouncing back from their sharpest fall in ten months, global investors remain cautious. The possibility of a full-blown trade war between the world’s two largest economies looms large. Market watchers are now focused on China’s next move—which could shape global trade and economic stability for months to come.

The Tariff That Shook the Markets

Trump’s Aggressive Trade Strategy

Former President Trump’s decision to push tariffs to a staggering 104% signals a no-holds-barred approach to confronting China on trade. The new levies are designed to pressure Beijing into withdrawing its own retaliatory measures and re-entering negotiations on America’s terms. Trump, known for his combative stance on trade, has warned of even more duties unless Beijing backs down.

India’s Market Reaction: A Surprising Rebound

Sensex and Nifty Soar Amid Global Uncertainty

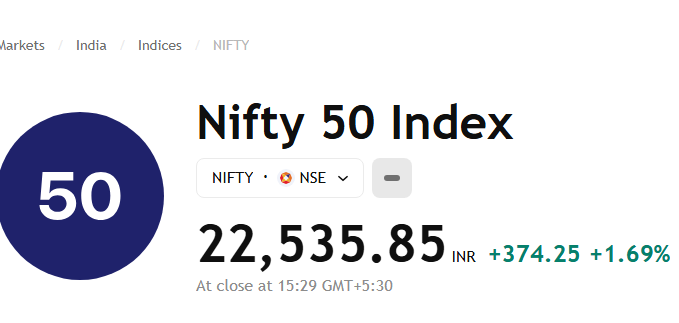

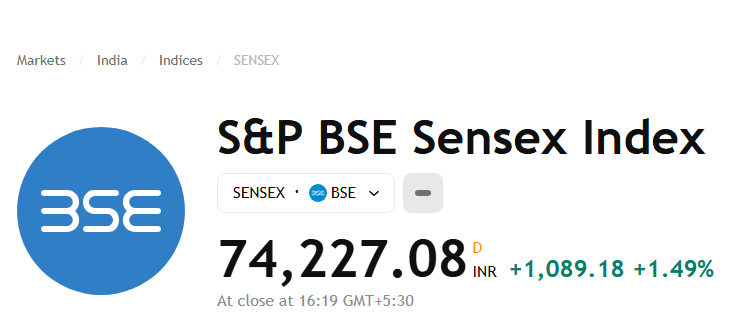

In a surprising twist, Indian stock markets closed higher on Tuesday. The Sensex surged by 1,089.18 points (1.49%) to settle at 74,227.08, while the Nifty 50 jumped 374.25 points (1.69%) to end at 22,535.85.

This rally was driven by bargain buying and growing optimism around potential global trade resets, especially between the U.S. and other major economies.

“Following positive global cues, led by the interest of many nations to enter into bilateral agreements with the U.S., the domestic market witnessed a recovery,” said Vinod Nair, Head of Research at Geojit Investments.

Why Indian Markets Stayed Resilient

Local Demand and Diplomatic Buffer

India’s relatively low reciprocal tariff system and increasing local demand make it more resilient to international shocks. In addition, India continues to hold ongoing trade negotiations with the U.S., potentially insulating it from the direct impact of the escalating U.S.-China dispute.

China’s Response: Retaliation on the Horizon?

Beijing’s Possible Countermeasures

China, taken aback by Washington’s aggressive tariff hike, is expected to hit back hard. Likely countermeasures include:

- Allowing the yuan to depreciate further, boosting export competitiveness.

- Imposing export restrictions on rare earth materials, crucial for tech and green energy industries.

- Targeting U.S. firms operating in China via its “unreliable entities” list.

- Suspending more agricultural imports from the U.S.

- Deepening ties with the EU and ASEAN to reduce American dependency.

These moves could lead to a multi-front economic retaliation, further roiling global markets.

Recent news

Canada Raises Minimum Wage: Indian Workers to Benefit : 2025

Wall Street Soars Up to 3% as Trade Hopes Lift Market Mood

What It Means for Global Trade & Diplomacy

Talks on the Brink of Collapse

With both sides hardening their stance, diplomatic efforts to resolve trade tensions could unravel. Trump has threatened to walk away from negotiations, while China may focus on building stronger alliances with other global players like the European Union, Russia, and Africa.

China’s Internal Shift Toward Self-Reliance

Facing mounting pressure from the U.S., China is expected to double down on high-tech self-sufficiency and stimulate domestic consumption, continuing its pivot toward a more internally driven economy.

RELATED NEWS – India Likely to Avoid Retaliation Over Trump’s 26% Tariff

Trump Tariff Shake Global Trade: India, Israel & Vietnam React 5

Conclusion: High Stakes, Uncertain Future

As the world watches this renewed trade war unfold, the implications are massive—not just for China and the U.S., but for emerging economies like India and global markets at large. While India’s domestic strength has helped it weather the initial storm, prolonged tensions could ripple across sectors. Investors, policymakers, and businesses will need to stay agile as the global economic order continues to shift.

Disclaimer:

This article is for informational purposes only. MoneyFlow Insight does not provide financial or legal advice. Readers should consult professionals before making investment decisions.

One thought on “Trump’s 104% Tariff on China Triggers Global Market Jitters”