Introduction :

In a surprising turn of events, former U.S. President Donald Trump has reignited global trade tensions by imposing a 125% tariff on Chinese imports, while pausing tariffs on over 75 other countries for 90 days. Announced via his Truth Social account, Trump cited China’s “disrespect for global markets” as the driving reason behind this aggressive move.

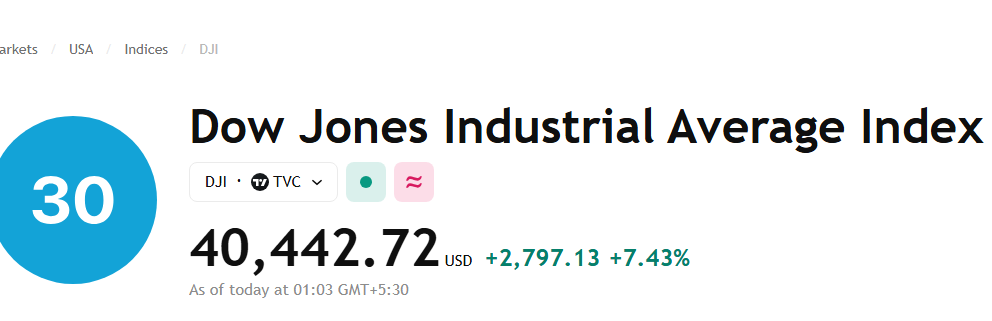

Meanwhile, Wall Street welcomed the pause for other nations, with the Dow Jones surging by 2700 points and the S&P 500 jumping 8.8%. While investors took a breath of relief, China’s sharp reaction—with increased tariffs on U.S. goods—indicates that the world’s largest economies are once again on the brink of an intense trade war. What does this mean for the global economy, U.S. allies, and the future of international trade? Let’s break it down.

Trump’s Tariff Pause: Relief for Most, Pressure on China

90-Day Relief Window for Over 75 Countries

Trump’s decision to pause tariffs came after more than 75 nations appealed for negotiation, offering to discuss trade barriers, currency policies, and tariffs. These countries were granted a 10% baseline reciprocal tariff, effective immediately.

“These countries have not retaliated, and we are opening the door to fair talks,” Trump wrote.

This move may reflect Trump’s attempt to stabilize market reactions while keeping political pressure on China.

Why China Is Excluded

According to Trump, China’s behavior in global trade continues to be exploitative, particularly in areas like:

- Currency manipulation

- Intellectual property violations

- Non-monetary trade barriers

He stated:

“China has shown a lack of respect to the world’s markets… It’s no longer sustainable or acceptable.”

By raising tariffs to 125%, Trump is essentially weaponizing trade as a geopolitical strategy to force Beijing back to the negotiating table—or punish them economically.

Wall Street’s Response: Market Surge Signals Relief

The tariff pause was seen as a positive signal for global commerce, sparking a significant market rally:

- Dow Jones jumped 2700 points

- S&P 500 climbed 8.8%, reaching 5,281.44

- Volatility Index (VIX) declined sharply

Investors interpreted this as a sign that Trump is open to compromise—at least with nations other than China. It also came after a volatile week following his earlier “Liberation Day” tariff announcement.

Recent news

Trump Announces 90-Day Tariff Pause for All Countries Except China: Markets Soar Amid Trade Shift

RBI Cuts Repo Rate to 6%, Turns Accommodative to Boost Growth

Nifty Falls Below 22,400 as Trump’s 104% Tariff Sparks Sell-Off

Trump’s 104% Tariff on China Triggers Global Market Jitters

China’s Response: Escalation in the Trade War

China responded almost immediately, increasing tariffs on U.S. imports from 34% to 84%. Analysts say this tit-for-tat could lead to:

- Higher prices on consumer goods

- Global supply chain disruptions

- Slower GDP growth in both countries

Beijing’s aggressive stance signals that neither side is backing down, raising fears of prolonged economic tension.

What This Means for the Global Economy

Short-Term Gains, Long-Term Uncertainty

While global markets are currently enjoying relief, economists warn of long-term instability if tensions with China continue to escalate.

A Two-Speed Trade Strategy

Trump’s approach shows a dual-track policy:

- Conciliation with allies

- Confrontation with rivals (China)

This could open up new trade opportunities but also split global supply networks in the long run.

Conclusion: Bold Move or Risky Gamble?

Trump’s 125% tariff on China, paired with a 90-day pause for others, reflects a bold but risky trade strategy. While financial markets have momentarily rebounded, the true impact of escalating U.S.-China tensions remains to be seen. Investors, governments, and businesses will now be watching how China responds in the coming weeks—and whether any real negotiations are on the horizon.

Disclaimer

The content on Money Flow Insight is for informational purposes only and does not constitute financial, investment, or legal advice. While we strive for accuracy, we recommend consulting a certified financial advisor before making any investment decisions. Money Flow Insight is not liable for any financial losses incurred based on information from this site.

3 thoughts on “Trump Hits China with 125% Tariffs, Markets React Fast”