Tata Stocks Bleed as Market Turns Volatile

In a shocking development on April 7, 2025, five of the top Tata Group companies saw their stock prices plummet, resulting in a combined loss of over ₹1.56 lakh crore in investor wealth. The sudden crash has sent tremors across Dalal Street, as major TATA STOCKS like Trent, TCS, Tata Motors, Titan, and Tata Steel experienced sharp corrections due to macroeconomic concerns and weak global cues.

Trent Tanks 19%, Worst Performer of the Day

Retail giant Trent Ltd emerged as the worst-hit Tata Group stock, plunging 19% to close at ₹4,491.75 from ₹5,561.25. The stock has now lost over 46% from its 52-week high, raising red flags among long-term investors.

- Market Cap Loss: ₹38,019 crore

- New Market Cap: ₹1.59 lakh crore

Analysts believe Trent’s steep valuation and rising input costs may have triggered the sell-off.

TCS Dips Amid Weak IT Sector Outlook

India’s largest IT company, TCS, also took a hit, reflecting the overall negative sentiment in the tech sector.

- Brokerage Views:

- HDFC Securities: ‘Add’ with ₹4,040 target

- Elara Capital: ‘Accumulate’ with ₹4,530 target

- Sector Outlook: InCred Equities sees 2025-26 as a “washout year” for IT firms due to global uncertainty. TATA STOCKS

Recent news

India Likely to Avoid Retaliation Over Trump’s 26% Tariff

India Sticks to FY26 Growth Forecast Amid Global Uncertainty

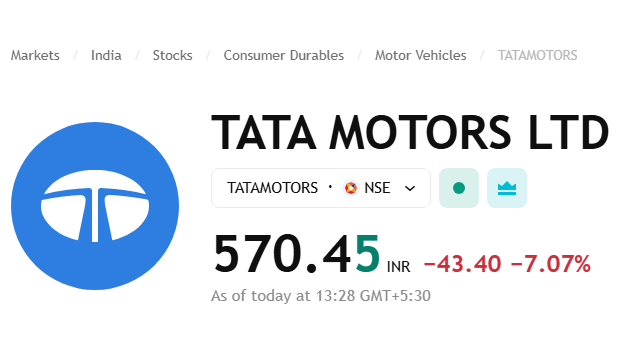

Tata Motors & Tata Steel Crack Over 11%

Tata Motors shares dropped 11.5%, reaching a 52-week low of ₹542.55. The automaker’s valuation fell by ₹26,246 crore, dragging it below the ₹2 lakh crore mark.

- Morgan Stanley: ‘Equalweight’ with ₹853 target

- CLSA: Downgraded to ‘Outperform’; reduced target to ₹765

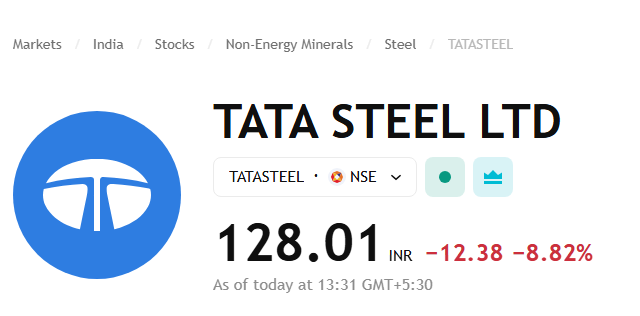

Tata Steel wasn’t spared either, sliding over 11.5% to ₹124.20.

- Market Cap Loss: ₹20,285 crore

- Kotak: ‘Sell’ with ₹120 target

- Prabhudas Lilladher: ‘Accumulate’ with ₹145 target

Titan Falls to 52-Week Low

Jewellery and wearables giant Titan Company also saw a 4% drop to ₹2,947.55.

- Market Cap Loss: ₹11,417 crore

- New Market Cap: ₹2.61 lakh crore

- JM Financial: ‘Hold’ with ₹3,550 target

Why Are Tata Stocks Falling?

Several factors have contributed to the sudden decline in Tata Group stocks:

- Weak global market sentiment due to fears of a US recession

- FII outflows amid geopolitical tensions and interest rate concerns

- Sector-specific challenges in IT, auto, and metals

- High valuations in retail and consumer stocks

Experts suggest that institutional investors might be booking profits ahead of FY25 Q4 earnings results and central bank announcements.

RELATED NEWS – TATA GROUP NEWS

What Should Investors Do?

While short-term panic is understandable, analysts recommend a measured approach:

- Long-term investors can consider this as a buying opportunity in quality Tata stocks at discounted prices.

- Short-term traders should be cautious and follow stop-loss strategies.

- Always consult a certified financial advisor before making any investment decisions.

Disclaimer:

MoneyFlowInsight provides financial news and analysis for informational purposes only. This is not investment advice. Please consult with a SEBI-registered financial advisor before making investment decisions.

One thought on “Trent, TCS, Titan Crash Up to 19%: Tata Stocks Wipe Off ₹1.56 Lakh Crore”