Introduction (100–150 words):

Indian stock markets soared on Friday, with the Sensex rising nearly 1,500 points and the Nifty crossing 22,800. The rally was driven by optimism over a potential India-US trade deal, following the US’s 90-day pause on reciprocal tariffs. This boosted investor sentiment, especially in metal, auto, and pharma sectors. Stocks like Adani Enterprises, Tata Steel, Cipla, and Tata Motors gained up to 5%. Positive cues from Asian markets also supported the uptrend. However, experts warn that volatility may continue as global developments unfold.

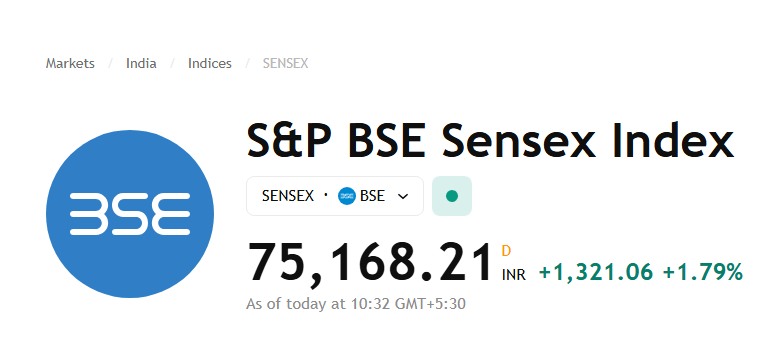

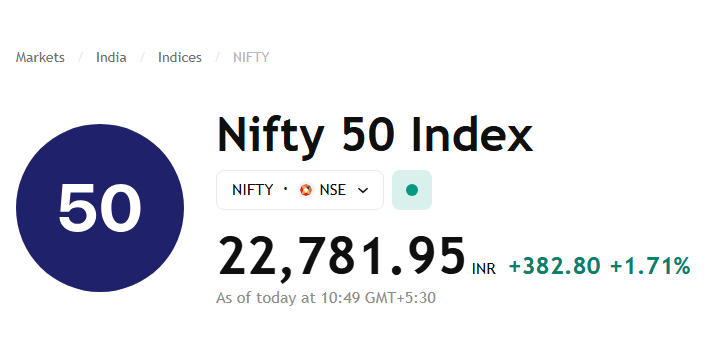

Sensex Nifty Rally: India-US Trade Hopes Lift Sentiment

The BSE Sensex surged 1,472.2 points, or 1.99%, to reach an intraday high of 75,319.35, while the NSE Nifty gained 475.3 points, or 2.12%, to hit 22,874.45. The rally was fuelled by the US decision to halt additional tariffs, raising expectations of an improved India-US trade relationship.

This positive news came at the right time, as markets had been shut on Thursday for Mahavir Jayanti, and investors returned hungry for opportunity. The rally was broad-based, with heavyweight and midcap stocks participating.

Top Nifty Gainers in the Sensex Nifty Rally

The top five gainers in the Nifty were:

- Adani Enterprises – surged ~5%

- Tata Steel

- Cipla

- JSW Steel

- Tata Motors

These stocks saw increased investor interest, especially with metals benefitting from the trade optimism and pharma remaining a defensive pick.

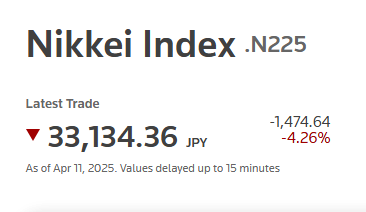

Global Markets React to Sensex-Nifty Rally

Global markets showed mixed reactions following the sharp rally in Indian indices, reflecting both optimism over U.S. tariff relief and ongoing global uncertainty.

- Japan’s Nikkei 225: Contrary to earlier reports of a surge, the index fell sharply by 4.26%, closing at 33,134.36 on Friday, likely due to profit booking after previous gains.

- Taiwan’s TAIEX Index: After a massive rally of over 1,600 points on Thursday, the index declined by 227.53 points, opening at 18,772.5 on Friday.

- Korea’s Kospi: Traded lower, continuing its cautious trend amid global volatility.

- Shanghai Composite & Hong Kong’s Hang Seng: Both edged up marginally, indicating a subdued but positive sentiment.

These mixed performances underline the fact that while the 90-day tariff pause by the U.S. has injected short-term optimism, markets remain cautious due to lingering economic uncertainties and geopolitical tensions.

🇺🇸 US Markets End in Red After Relief Rally

In contrast to Asia, US markets closed sharply lower on Thursday:

- Nasdaq Composite fell 4.31%

- S&P 500 slumped 3.46%

- Dow Jones dropped 2.50%

This correction followed a day of euphoria and indicates investors are still wary of deeper economic concerns like inflation, Fed policies, and global trade uncertainties.

Recent news

Trump Unleashes Devastating 145% Tariff on Chinese Goods, Deepening US-China Trade War

Sun Pharma Secures Major Win with Leqselvi U.S. Launch Approval (2025)

Expert View on the Sensex Nifty Rally and Market Outlook

Anand James, Chief Market Strategist at Geojit Financial Services, offered a nuanced take on the current market scenario. According to him, volatility is likely to stay elevated in the near term as the markets continue to digest both domestic and global developments, especially after the mid-week holiday closure.

He noted that while there was already an expectation of an upward movement in the indices, the team at Geojit refrained from setting a clear upside target due to the India VIX remaining above the 21 mark, indicating persistent investor uncertainty.

James further added that if the Nifty sustains above 22,850, we may see continued strength and buying interest in the market. A break above 23,140 could even trigger a fresh round of bullish momentum. However, on the downside, any dip toward 22,500 might attract renewed buying, while a fall below 22,350 could introduce weakness, although a steep decline below 22,160 appears less likely at this stage.

He highlighted critical levels to watch:

- If Nifty breaks above 23,140, another bullish leg could begin

- Sustained trade above 22,850 signals continued strength

- Any correction to 22,500 might invite fresh buying

- A break below 22,350 may weaken sentiment

- A fall below 22,160, however, is considered unlikely at this stage

Sector-Wise Snapshot

- Metals: Big winners today, with global demand outlook improving

- Automobile: Tata Motors among top gainers, riding on global demand recovery

- Pharma: Defensive buying helped Cipla surge

- Banking & Financials: Participated moderately, but still posted decent intraday gains

Disclaimer

The views and investment tips expressed by experts are their own and do not reflect the opinions of Money Flow Insight. We encourage investors to seek advice from certified financial professionals before making any market decisions.

2 thoughts on “Sensex Soars 1,500 Points, Nifty Nears 22,900 on Trump Tariff Pause Boost”