Indian stock markets continued their upward journey on Monday, with benchmark indices registering sharp gains, fueled by positive sentiments across sectors. The Sensex surged over 1,000 points, and the Nifty crossed the crucial 23,600 level, extending gains for the sixth consecutive session. This rally comes on the back of strong foreign institutional investor (FII) inflows, value buying, and renewed optimism around fourth-quarter corporate earnings…

The BSE Sensex soared by 1.4% or 1,078.87 points, settling at 77,984.38, while the Nifty 50 gained 1.32% or 307.95 points, closing at 23,658.35. Market experts suggest that short-covering ahead of the monthly Futures & Options (F&O) expiry, improving domestic macroeconomic indicators, and favorable global cues have contributed to the rally. Sensex

FII Inflows and Domestic Macros Drive Market Sentiment

One of the primary drivers of this sharp upmove has been the renewed interest of foreign investors in the Indian equity market. After witnessing outflows in previous weeks, foreign portfolio investors (FPIs) turned net buyers as the Indian rupee weakened, making domestic stocks more attractive.

According to Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd., “The fall in the Indian currency and positive global market cues, especially from the US and Europe, have lifted investor sentiment. The moderation in domestic inflation and expectations of a rate cut by the Reserve Bank of India (RBI) have further supported this rally.”

Market analysts are predicting a 25 basis point (bps) repo rate cut by the RBI, which is expected to be announced in the upcoming monetary policy review on April 9. This possibility of monetary easing has turned investor focus towards rate-sensitive sectors such as banking, NBFCs, auto, consumer durables, and real estate, where significant buying was seen.

RELATED NEWS:-Markets Rise for 6th Day: Sensex Soars 900 Points, Nifty Crosses 23,600 on Strong Bank Shares | Money Flow Insight

Sectoral Surge: Banks, Realty, and Energy Lead the Charge

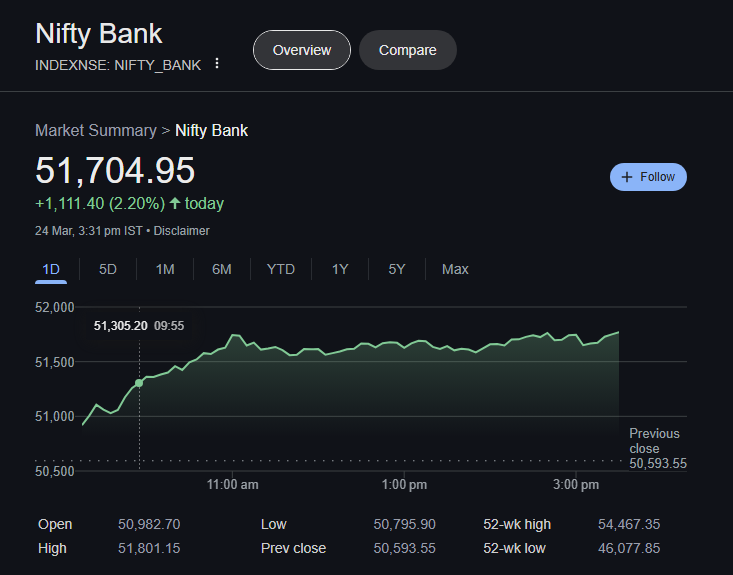

The market witnessed broad-based buying, with all sectoral indices closing in the green. Leading the pack were Nifty PSU Banks, Private Banks, Realty, and Oil & Gas sectors. Investors are particularly bullish on public sector banks (PSBs) and real estate stocks, driven by hopes of better credit growth and increased infrastructure spending by the government.

Vinod Nair, Head of Research at Geojit Financial Services, noted, “The domestic market experienced a robust rally, spurred by value buying as valuations returned to long-term averages and early signs of earnings recovery became evident.” He further added that increased government spending and potential monetary easing will likely keep the positive momentum going, especially in sectors like banking and real estate. Sensex

Meanwhile, midcap and smallcap stocks continued their winning streak, reflecting strong participation from retail investors. The Nifty Midcap 100 index rose by 1.3%, while the Nifty Smallcap 100 index jumped 1.1%, showcasing the underlying strength in the broader market.

Technical Outlook: Nifty Eyes 24,000, Support Shifts Higher

From a technical analysis perspective, the Nifty has now retraced over 38.2% of the recent correction, which began from the all-time high of 26,277 and bottomed out at 21,964. Experts believe that the next resistance level for the index is around 23,807, followed by a major resistance at 24,125 – the 50% retracement level of the previous fall.

Nandish Shah, Deputy VP at HDFC Securities, mentioned, “By surpassing 23,612, Nifty has shown strength and shifted immediate support to 23,400 levels.” If the index sustains above these levels, it may well march towards the 24,000 mark in the coming sessions, driven by earnings data and global market trends.

Conclusion

The Indian stock market has entered a bullish phase with strong institutional support, positive macroeconomic indicators, and rising earnings expectations. While near-term volatility cannot be ruled out, the underlying tone remains optimistic. The coming weeks will be crucial, especially with Q4 earnings, RBI’s policy decision, and global market developments on the radar. Investors should stay cautiously optimistic and continue tracking fundamentals while making informed decisions.