Introduction

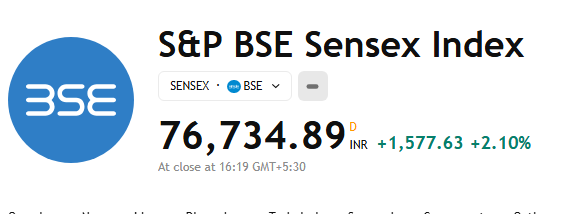

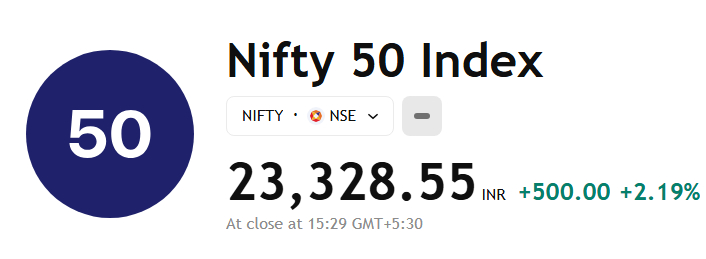

Indian stock markets soared on Monday, with both the Sensex and Nifty climbing more than 2%, fueled by a wave of positive global cues. Among the top drivers was the news of the US extending tariff exemptions on several Chinese goods — a move that brought relief to global investors and bolstered risk appetite. The rally was further supported by strong foreign institutional investments (FIIs), firm global market trends, and upbeat sentiment in domestic sectors like auto, banking, and IT. The bullish tone of the market reflected growing confidence in global economic stability and improving trade relations.

US Tariff Exemptions Calm Global Nerves

One of the biggest contributors to Monday’s rally was the decision by the United States to extend tariff exemptions on more than 300 Chinese products. This strategic move has eased fears of a renewed trade war between the two largest economies in the world. Investors across the globe perceived this as a sign of easing geopolitical tensions, prompting heavy buying in equities.

Markets have been jittery over the past few months due to uncertainty around US-China trade policies. The recent exemption offers a window of stability, particularly for global supply chains, and indicates that the US is seeking a more cooperative trade approach in the near term. Indian markets mirrored this optimism, with foreign investors returning to Dalal Street in a big way.

Sensex and Nifty See Broad-Based Buying

The Sensex surged over 1,450 points to close above 73,500, while the Nifty crossed the key 22,300 level. The rally was broad-based, with all sectoral indices ending in the green.

- Banking stocks led the charge, with ICICI Bank, HDFC Bank, and SBI posting gains of 3–5%.

- IT majors like TCS, Infosys, and Wipro also gained on expectations of stronger US client spending.

- Auto stocks such as Tata Motors and Mahindra & Mahindra rallied on improved outlook and strong sales forecasts.

The rally wasn’t limited to large caps — even midcap and smallcap indices recorded healthy gains, signaling widespread investor participation.

Top Gainers of the Day

Several heavyweight stocks posted remarkable gains, contributing significantly to the day’s sharp upmove. Here are some of the top performers on the Nifty:

- Adani Enterprises: +7.2% – Surged on strong buying interest across the Adani Group stocks.

- Tata Motors: +6.5% – Continued momentum on robust sales outlook and EV push.

- Grasim Industries: +5.8% – Rose after brokerage upgrades and positive sector cues.

- ICICI Bank: +4.9% – Strong rally in banking boosted by FIIs and credit growth optimism.

- Infosys: +4.3% – Gained ahead of earnings amid positive IT sector outlook.

These stocks were among the most active in terms of volumes and reflect investor confidence in India’s growth prospects.

RELATED NEWS-

FII Inflows and Domestic Sentiment Add Fuel

Foreign Institutional Investors (FIIs) were net buyers in Indian equities for the fifth consecutive session, adding further momentum to the market. Data shows that FIIs poured in over ₹3,500 crore on Monday alone, as they sought to capitalize on attractive valuations and stable economic indicators in India.

Domestically, sentiment was lifted by falling crude oil prices and expectations that the Reserve Bank of India (RBI) will maintain its accommodative stance amid manageable inflation. Additionally, strong quarterly earnings by select companies have also kept the market’s momentum intact.

Global Markets in Sync With India’s Rally

The positive trend wasn’t limited to Indian markets. Major global indices like the Dow Jones, FTSE, and Nikkei also posted strong gains as traders bet on a softer US trade stance and improving global demand outlook. Asian peers, including China and South Korea, also recorded gains, highlighting the global nature of this rally.

Experts believe the current bounce is a combination of relief from trade tension fears and a renewed belief in global growth for the second half of the year.

What Investors Should Watch Next

While Monday’s rally was encouraging, analysts caution that investors should remain vigilant. Key things to watch in the coming days include:

- Upcoming Q4 earnings results of major companies

- Any updates from the US Federal Reserve regarding interest rates

- Continued monitoring of geopolitical developments, especially in the Middle East and Eastern Europe

- Trends in commodity prices, especially crude oil and metals

Long-term investors, however, are advised to stay invested and look for buying opportunities in quality stocks during dips.

Conclusion

Today’s 2% surge in Sensex and Nifty clearly shows that global policy decisions — like the US tariff exemption — can significantly influence investor sentiment. With easing global tensions, strong FII flows, and optimistic earnings expectations, Indian markets are poised for further upward momentum. However, investors should stay alert to global cues and macroeconomic developments to make informed decisions in this volatile environment.

Disclaimer:

This article is for informational purposes only. MoneyFlowInsight does not provide legal, financial, or professional advice. Please verify facts through official sources before taking any action.

One thought on “Market Soars Over 2%: US Tariff Exemptions Boost Sensex, Nifty”