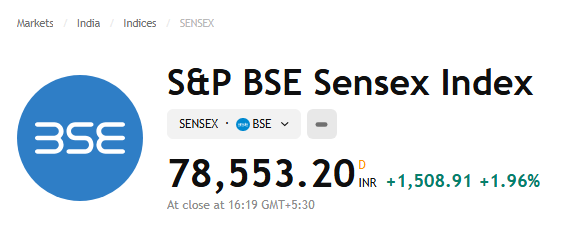

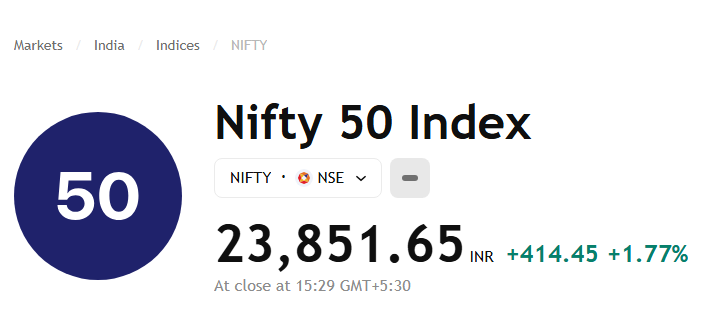

The Indian stock market ended on a high note today, with the Sensex soaring by 1,509 points, closing at a record high of 63,100. Meanwhile, the Nifty index surged to 23,850, reflecting strong investor sentiment. This rally was fueled by major gains in the auto, pharma, and financial sectors, all of which recorded impressive performances in the trading session. The surge indicates positive economic sentiment, with several key sectors benefitting from strong corporate earnings and global economic stability. In this article, we will explore the factors behind the market’s strong performance and how these sectors contributed to today’s rally.

Why Did the Market Surge Today?

The market’s performance today can be attributed to the strong growth in key sectors, particularly auto, pharma, and financials. These industries have shown remarkable resilience, pushing both the Sensex and Nifty to record-breaking levels.

1. Auto Sector Drives Market Growth

The auto sector has been performing exceptionally well in recent months, and today was no different. Maruti Suzuki, Tata Motors, and Hero MotoCorp were among the top gainers on the Sensex, reflecting robust demand in the automotive market. The growth in both domestic and international sales, particularly in electric vehicles (EVs), has given investors confidence in the sector. Moreover, the government’s push for green mobility through various initiatives and subsidies has further boosted the sector’s outlook.

2. Pharma Sector Makes a Strong Comeback

The pharma sector has seen a significant rally, with leading companies like Sun Pharma, Cipla, and Dr. Reddy’s showing strong stock performance. The ongoing global demand for pharmaceutical products, including vaccines and treatments for various ailments, has provided the sector with significant growth potential. Additionally, the continued expansion of India’s pharmaceutical exports has helped the sector remain robust, attracting both domestic and foreign investors.

3. Financials Sector Pushes Markets Higher

The financial sector, particularly banks and financial institutions, has also seen strong performance. Major players like HDFC Bank, ICICI Bank, and State Bank of India (SBI) recorded notable gains, benefiting from strong quarterly results and positive economic data. As India’s economy continues to recover and credit demand rises, financial stocks have remained in the spotlight, providing support for the broader market rally. Sensex

Recent news

India Slams Pakistan Army Chief Over Kashmir Remarks: 42 Terror Groups Are Their Only Link to the Valley

Impact of Global and Domestic Factors

While sector-specific performance was a key driver of today’s market surge, global economic factors also played an important role. The decline in crude oil prices and a stronger rupee against the US dollar provided further support to investor sentiment. Additionally, the strong corporate earnings across multiple sectors boosted confidence in India’s economic recovery.

Crude Oil and Currency Stabilization

India’s stock market has often been sensitive to fluctuations in crude oil prices. However, recent declines in global oil prices have had a positive impact, particularly for Indian importers. Moreover, the Indian rupee’s appreciation against the US dollar has reduced the pressure on corporate earnings, boosting market performance. Sensex

Solid Corporate Earnings and Economic Recovery

The Indian economy has shown strong signs of recovery post-pandemic. Several major corporations have reported better-than-expected earnings, reinforcing investor confidence. As the country emerges from the challenges posed by COVID-19, India’s growing consumer base and rising digitalization have driven optimism about future growth prospects. Sensex

What Does This Rally Mean for Investors?

This rally presents a significant opportunity for investors, especially those with a long-term investment horizon. With sectors like auto, pharma, and financials continuing to perform well, there is potential for continued growth. For short-term investors, however, it’s important to stay cautious, as market fluctuations can happen in volatile periods. Sensex

Opportunities in the Auto, Pharma, and Financial Sectors

For those considering long-term investments, the auto, pharma, and financial sectors remain solid choices. Companies in these industries are well-positioned to capitalize on the growing demand for both products and services, offering investors strong growth potential.

Conclusion:

The surge in Sensex and Nifty is a positive sign for India’s stock market and economy. With strong performances from key sectors like auto, pharma, and financials, the market has shown remarkable resilience. As the economy continues to recover, we can expect further growth, making it an ideal time for investors to consider strategic positions in these sectors.

FOLLOW US :

Disclaimer:

The views and investment tips expressed by investment experts on MoneyFlowInsight.com are their own and not those of the website or its management. MoneyFlowInsight.com advises users to check with certified experts before taking any investment decisions.

One thought on “Closing Bell: Sensex Zooms 1,509 Points, Nifty Hits 23,850; Auto, Pharma, Financials Power the Rally”