On May 5, 2025, the Indian stock market witnessed a strong rally. On the first trading day of the week, investors showed heavy buying interest in IT, FMCG, Auto, and Energy sector stocks. Both key indices – Sensex and Nifty – closed at new record highs. In this article, we’ll analyze sector-wise performance, top gainers and losers, and the major factors that influenced the market. Sensex

Key Index Performance

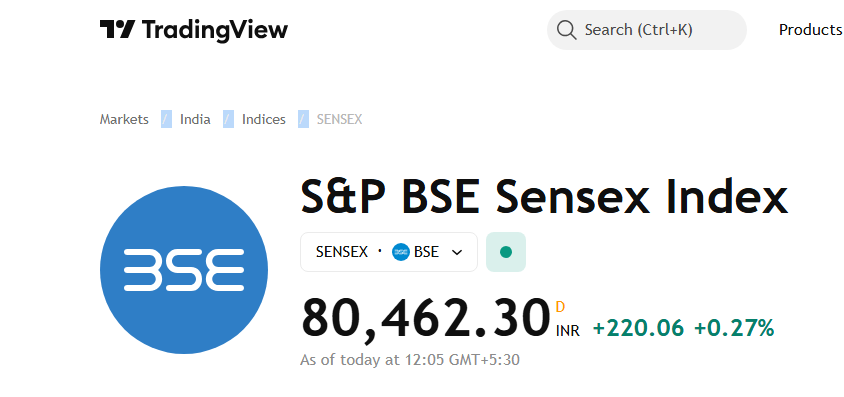

BSE Sensex

The benchmark index of the Bombay Stock Exchange (BSE), the Sensex, closed at 80,796.84, gaining 294.85 points or 0.37%.

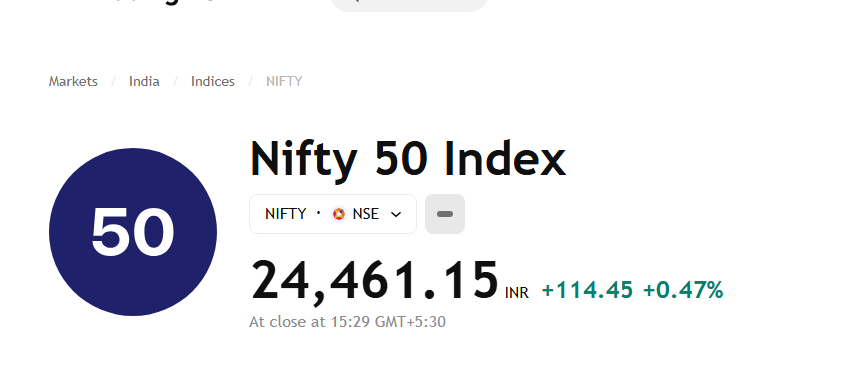

NSE Nifty 50

The key index of the National Stock Exchange (NSE), the Nifty 50, ended the session at 24,461.15, up 114.45 points or 0.47%.

These numbers clearly indicate a strong positive sentiment in the market, with continued investor confidence.

Sector-Wise Performance: Which Sectors Performed Well?

1. IT Sector

IT companies showed up to 1% gains, primarily due to positive economic cues from the US and a stable Indian rupee against the dollar. This strengthened the confidence in export-oriented tech stocks.

2. Auto Sector

After Mahindra & Mahindra posted excellent quarterly results, the Auto sector saw robust gains. The sector rose by around 1.2%, supported by strong earnings and festive season expectations.

3. Energy & Power Sector

Declining crude oil prices boosted the profit outlook of energy companies. Shares of Reliance Industries and ONGC showed good momentum.

4. FMCG Sector

Buying interest in heavyweights like ITC and Hindustan Unilever pushed the FMCG sector higher, backed by rural demand recovery and easing input costs.

Top Gainer Stocks – Stocks That Gained the Most Today

| Company Name | Gain (%) |

|---|---|

| Mahindra & Mahindra | +3.11% |

| ITC Ltd. | +1.62% |

| Adani Ports | +2.45% |

| Adani Enterprises | +2.38% |

| Trent | +2.12% |

| Shriram Finance | +1.98% |

Key Reasons for Gains:

- Strong Q4 earnings

- Positive sector outlook

- Increased demand and investor optimism Sensex

Top Loser Stocks – Stocks That Declined Today

| Company Name | Loss (%) |

|---|---|

| Kotak Mahindra Bank | -4.57% |

| ONGC | -1.42% |

| Dr. Reddy’s Labs | -1.35% |

| JSW Steel | -0.87% |

| SBI | -0.68% |

Key Reason for Losses:

- Kotak Mahindra Bank fell sharply due to weak quarterly results, dragging the banking sector lower.

Midcap and Smallcap Stocks Performance

BSE Midcap Index

The midcap index surged by 1.45% as investor interest in medium-sized companies continues to grow. Valuation comfort and growth potential are key drivers.

BSE Smallcap Index

The smallcap index also gained 1.23%, supported by retail investor participation and positive sentiment around emerging businesses.Sensex

Major Factors Driving the Market Rally

1. Easing Global Trade Tensions

Recent signals of improving trade relations between India and the US boosted market sentiment. Investors are optimistic about future bilateral cooperation.

2. Continued Foreign Investor Buying

Foreign Portfolio Investors (FPIs) have bought into the Indian markets for the 12th straight session, improving liquidity and supporting the rally.

3. Falling Crude Oil Prices

The decline in international crude oil prices helped reduce India’s trade deficit and inflation concerns, positively impacting sectors like energy and FMCG. Sensex

Investment Advice

For Long-Term Investors

- Midcap and FMCG sectors look promising due to consistent demand and favorable valuation.

- Investors with a long-term horizon can accumulate quality stocks in these segments.

For Short-Term Traders

- Focus on IT and Auto sectors, which are currently showing momentum.

- However, expect some volatility, so short-term trades should be executed with caution.

Risk Management Tip

- Be cautious in the banking sector, especially stocks like Kotak Mahindra Bank, which have shown weakness due to earnings miss. Sensex

Conclusion

The Indian stock market displayed strong enthusiasm on May 5, 2025, supported by favorable global cues, solid quarterly results, and continuous foreign investment inflow. While sectors like IT, Auto, Energy, and FMCG led the charge, banking stocks showed signs of pressure. Investors are advised to stay alert and make informed decisions based on fundamentals and market trends.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information.