The Indian stock market witnessed a sharp decline on Tuesday as benchmark indices Sensex and Nifty plummeted over a percent, driven by a sell-off in IT and real estate stocks. Investor sentiment was dampened by growing concerns over US President Donald Trump’s proposed reciprocal tariffs, which added to global uncertainty.

Sensex and Nifty Face Heavy Selling Pressure

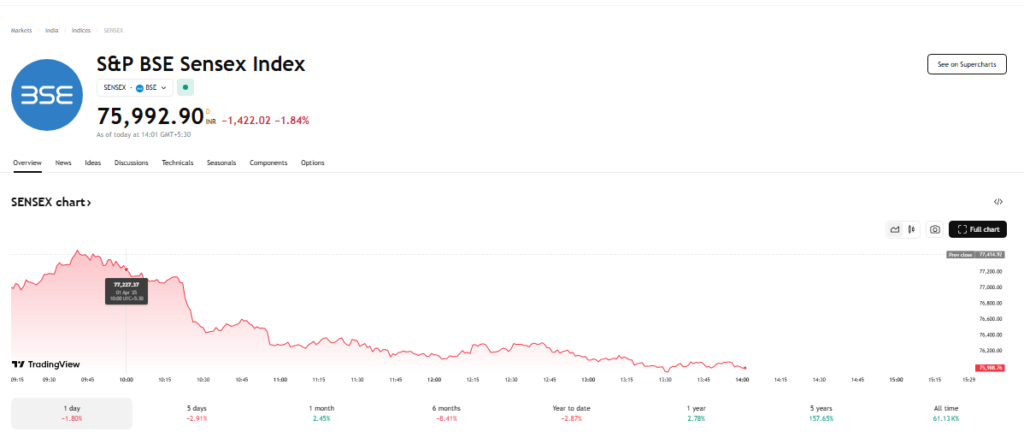

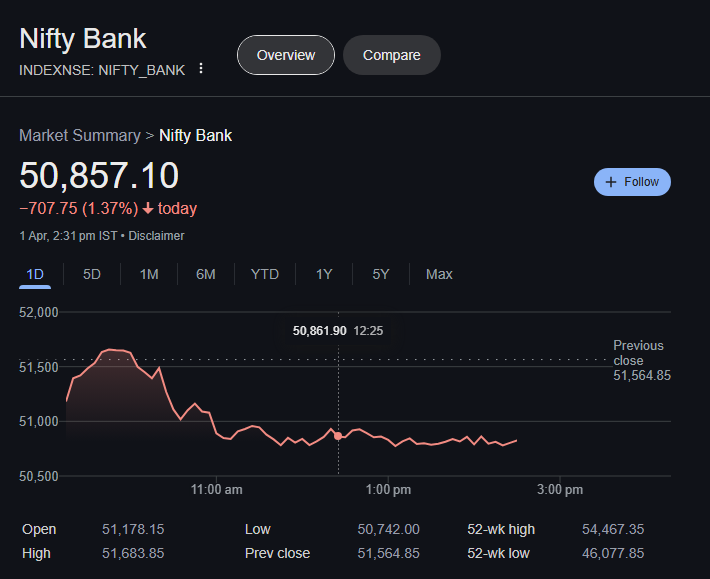

The BSE Sensex plunged as much as 1,502.94 points, or 1.94 percent, hitting an intraday low of 75,912.18. Meanwhile, the NSE Nifty tumbled 382.95 points, or 1.62 percent, to 23,136.40. The indices opened in deep red, recovered some losses in early trade, but slipped again as selling pressure intensified.

IT Stocks Lead Market Decline

The technology sector bore the brunt of the sell-off, with major IT stocks witnessing a steep fall. Companies like Infosys, TCS, Wipro, and HCL Technologies dragged the indices lower as investors worried about potential trade restrictions from the US. The IT sector has significant exposure to the American market, and any adverse trade policy could negatively impact revenue streams.

US Tariff Uncertainty Weighs on Investor Sentiment

The primary trigger behind Tuesday’s stock market Sensex crash was uncertainty surrounding US trade policies. President Donald Trump’s push for reciprocal tariffs on foreign goods raised fears of trade disruptions, particularly affecting Indian companies with a strong global presence.

Real Estate Stocks Follow IT in Declines

Real estate stocks also saw a significant drop as fears of rising interest rates and inflationary pressures grew. With global economic conditions remaining volatile, foreign institutional investors (FIIs) seemed to take a cautious approach, offloading positions in the real estate and infrastructure segments.

Sensex and Nifty Volatility Ahead of Key Events

Market volatility is expected to persist in the coming weeks as investors assess various factors:

- Global Trade Developments: Any further announcements from the US regarding trade tariffs could keep the markets under pressure.

- Inflation and Interest Rates: Rising inflation remains a major concern for global economies, prompting central banks to adopt a tighter monetary policy.

- Corporate Earnings: The ongoing earnings season will also play a crucial role in determining the market trajectory. Investors will be closely watching quarterly reports to gauge the financial health of key companies.

FIIs and DIIs Reaction to the Market Fall

Foreign Institutional Investors (FIIs) were seen selling equities worth significant amounts, leading to a sharp downturn. On the other hand, Domestic Institutional Investors (DIIs) attempted to cushion the fall by picking up selective stocks, but the overall market sentiment remained bearish.

Expert Views on Market Outlook

Market analysts believe that the ongoing correction is a result of external uncertainties and profit-booking at higher levels. Many experts suggest that long-term investors should not panic and instead use this correction as an opportunity to accumulate quality stocks.

According to market strategist Rajesh Mehta, “While the immediate reaction to US trade policies has triggered this decline, long-term fundamentals of the Indian economy remain intact. Investors should focus on value buying in this correction phase.”

infosys share price today

MARUTI

How Should Investors React?

For retail investors, this market decline presents both challenges and opportunities. Here’s how investors can navigate the situation:

- Avoid Panic Selling: Short-term volatility should not dictate long-term investment decisions.

- Focus on Strong Fundamentals: Companies with robust balance sheets and strong earnings growth potential should be prioritized.

- Diversification is Key: A well-diversified portfolio across sectors can help mitigate risks in turbulent markets.

- Stay Updated on Global Developments: Tracking trade policies, inflation trends, and central bank decisions will help in making informed investment choices

Conclusion: Markets Likely to Stay Volatile

With concerns over US tariffs adding to market jitters, Indian equities may continue to experience fluctuations in the short term. However, underlying economic fundamentals remain strong, and long-term investors can view this correction as a strategic buying opportunity. As global trade dynamics unfold, market participants should stay cautious and adopt a well-researched investment approach to navigate uncertain times.

Recent news

Vodafone Idea Shares Surge 15% as Government Converts Dues into Equity

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial or investment advice. Investors are advised to conduct their own research or consult with a financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses incurred based on the information provided in this article.

2 thoughts on “Sensex Crashes 1,500 Points, Nifty Slips Below 23,200 Amid US Tariff Concerns”