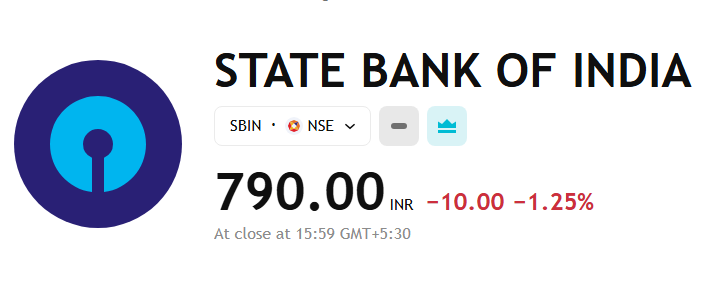

Shares of India’s largest public sector bank State Bank of India (SBI) have been on a decline recently. On Friday, SBI shares fell 1.26% to close at ₹ 790.00, down 13.39% from its previous 52-week high of ₹ 912.10. This decline has come at a time when the company has released its fourth quarter financial results.

So is this just a temporary setback or is it a big signal for investors? Let’s know in detail.

SBI shares fall – understand in figures

| Details | Statistics |

|---|---|

| Current Share Price | ₹790.00 |

| Percentage Decline | 1.26% |

| 52-week High | ₹912.10 |

| Difference from Highest | -13.39% |

| Market Cap | ₹7.05 lakh crore (approx) |

| Q4 Net Profit | ₹18,642.59 crore (10% decline) |

Why did this decline happen? (5 main reasons)

1.Profit decline in fourth quarter

SBI’s net profit declined 10% to ₹18,642 crore in this quarter. While these figures are still huge, analysts had higher expectations.

This is the first time SBI’s profit has declined this fiscal.

2.Decline in Net Interest Margin (NIM)

The bank’s Net Interest Margin declined to 3.47% in Q4 from 3.53% in the previous quarter. This indicates that the bank’s expected profit on loans is falling.

3.Market sentiment and analyst reactions

- When a large company’s profit falls, it is normal for investors to panic.

- This led to many institutional investors selling, which put pressure on the stock.

4.Global uncertainties

Rising interest rates in the US, fall in crude oil prices and strengthening of China’s currency Yuan have affected the thinking of foreign investors. This has also caused turmoil in the market.

5.Breakdown on technical chart

SBI stock has broken the support level of ₹ 800 and has fallen below it, due to which technical analysts are considering it weak. Some brokerage firms are now advising to “Hold” or “Buy on Dip” on this stock.

Is this the right time to buy?

Golden opportunity for long term investors

- SBI’s fundamentals are strong.

- It is playing a leading role in digital banking.

- Dividend yield is attractive (1.71%), i.e. reliable in terms of returns.

If you are an investor with a period of 3 to 5 years, then this fall can be an opportunity for you to buy at a discount.

Caution for short term traders

- Volatility may continue for the next few weeks.

- The stock may go down under pressure of quarterly results.

- Next support is considered between ₹ 770 and ₹ 750.

What do experts say?

Motilal Oswal:

“SBI is a strong PSU bank, but Q4 results were weaker than expected. We maintain a target of ₹900+ in the medium term.”

ICICI Securities:

- “Adopt a Buy on Dip strategy. The stock valuation is attractive.“

Zerodha:

“If closing is below ₹780, trade with a stop loss.

Tips for investors (Step-by-Step)

Step 1: Look at the fundamentals

If the company’s balance sheet is strong, then there is no need to panic about short-term decline.

Step 2: Do SIP

By buying a little bit on every decline, good returns can be obtained in the long term.

Step 3: Risk management

If you are trading, then definitely place a stop loss. Below ₹ 770, the risk may increase.

Future Prospects (2025 and beyond)

- Digital Banking: YONO and other digital products can benefit SBI in the future.

- Corporate Loan Growth: SBI’s participation in infrastructure and MSME sector is increasing.

- Government Support: SBI can benefit from the government’s PSU reform program.

Conclusion: What should investors do?

- This fall in SBI shares is a signal to investors that market sentiments are not always stable.

- But strong fundamentals, government support and wide network make it a reliable bank even now.

- If you are a long term investor, this is not the time to panic but to act wisely.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information.

One thought on “SBI Share Price Falls Sharply by 1.26% to ₹790 – Concern for Investors?”