New Delhi, May 2, 2025: JSW Steel has suffered a major setback from the Supreme Court. The country’s highest court has ordered the liquidation of the company, terming JSW Steel’s plan to acquire Bhushan Power and Steel (BPSL) illegal. JSW Steel holds 83.3% stake in BPSL as of October 1, 2021.

Why did the Supreme Court’s decision come?

The Supreme Court based its decision on two major reasons:

- JSW Steel had used optionally convertible debentures (OCDs) along with equity for the acquisition. Whereas according to the Insolvency and Bankruptcy Code (IBC), the acquisition should have been done only through equity.

- JSW Steel failed to implement the plan within the stipulated time frame. Under the IBC, the resolution plan had to be implemented within a time frame of 330 days, which JSW could not meet.

This decision has not only brought JSW Steel’s strategy into question, but it can also prove to be a turning point in the country’s major insolvency process.

Impact on JSW Steel shares

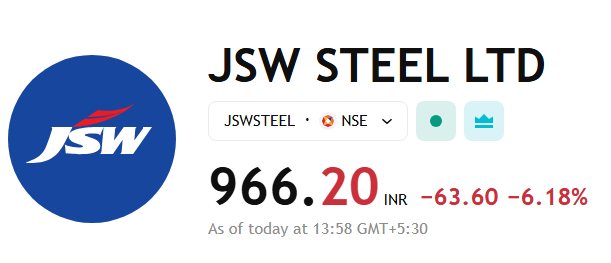

Soon after this decision, at 11:58 am on May 2, JSW Steel shares were trading down by about 6% at ₹ 971 per share on the BSE. This is a negative sign for investors and is raising concerns over the company’s position in the market.

What is the case of Bhushan Power and Steel (BPSL)?

BPSL was dragged to the bankruptcy court (NCLT) by Punjab National Bank (PNB) and other banks as the company could not repay its loans on time.

- A total of ₹ 47,158 crore worth of debt claims were filed on BPSL.

- The company was one of the 12 large companies identified by the Reserve Bank of India (RBI), which were first included in the bankruptcy process.

- After this, the auction process of BPSL started through NCLT, and JSW Steel acquired it.

Money laundering case is also involved

BPSL has already been in controversies. In 2020, the Enforcement Directorate (ED) registered a case against BPSL and its then chairman and managing director on charges of bank fraud and money laundering of ₹ 47,000 crore.

However, earlier this year, the Delhi High Court had quashed the money laundering proceedings against BPSL, giving some relief to JSW. But now the Supreme Court’s decision can create a crisis again.

What will the bank benefit?

In this case, Punjab National Bank (PNB) still hopes that it will be able to recover about ₹ 3,800 crore from BPSL. The bank’s MD and CEO S.S. Mallikarjuna Rao had earlier said that this recovery will help them achieve the target of cash recovery of ₹ 8,000 crore in the current financial year.

Experts’ opinion

Experts believe that this decision can set a precedent in India’s insolvency resolution process. Big companies like JSW Steel have been given the message that if they violate IBC laws, they can face legal setbacks, no matter how big the deal they have made.

What next?

Now that the Supreme Court has ordered liquidation, BPSL’s assets will be sold next. This may also include JSW Steel’s stake. This will not only affect JSW’s financial position, but its image may also be damaged.

History of BPSL Dispute

BPSL was dragged to the bankruptcy court (NCLT) by Punjab National Bank (PNB) and other banks in 2017 after the company failed to repay a debt of ₹47,158 crore.

- RBI had put BPSL in the list of 12 large companies that were first to be put into the insolvency process.

- The company was auctioned, in which JSW Steel made the highest bid and acquired it.

Conclusion

The cases of JSW Steel and Bhushan Power and Steel have made it clear that transparency and compliance with the law will be given top priority in the insolvency process. This decision of the Supreme Court sends a strong message to the Indian corporate world regarding corporate governance and ethical investment.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information.