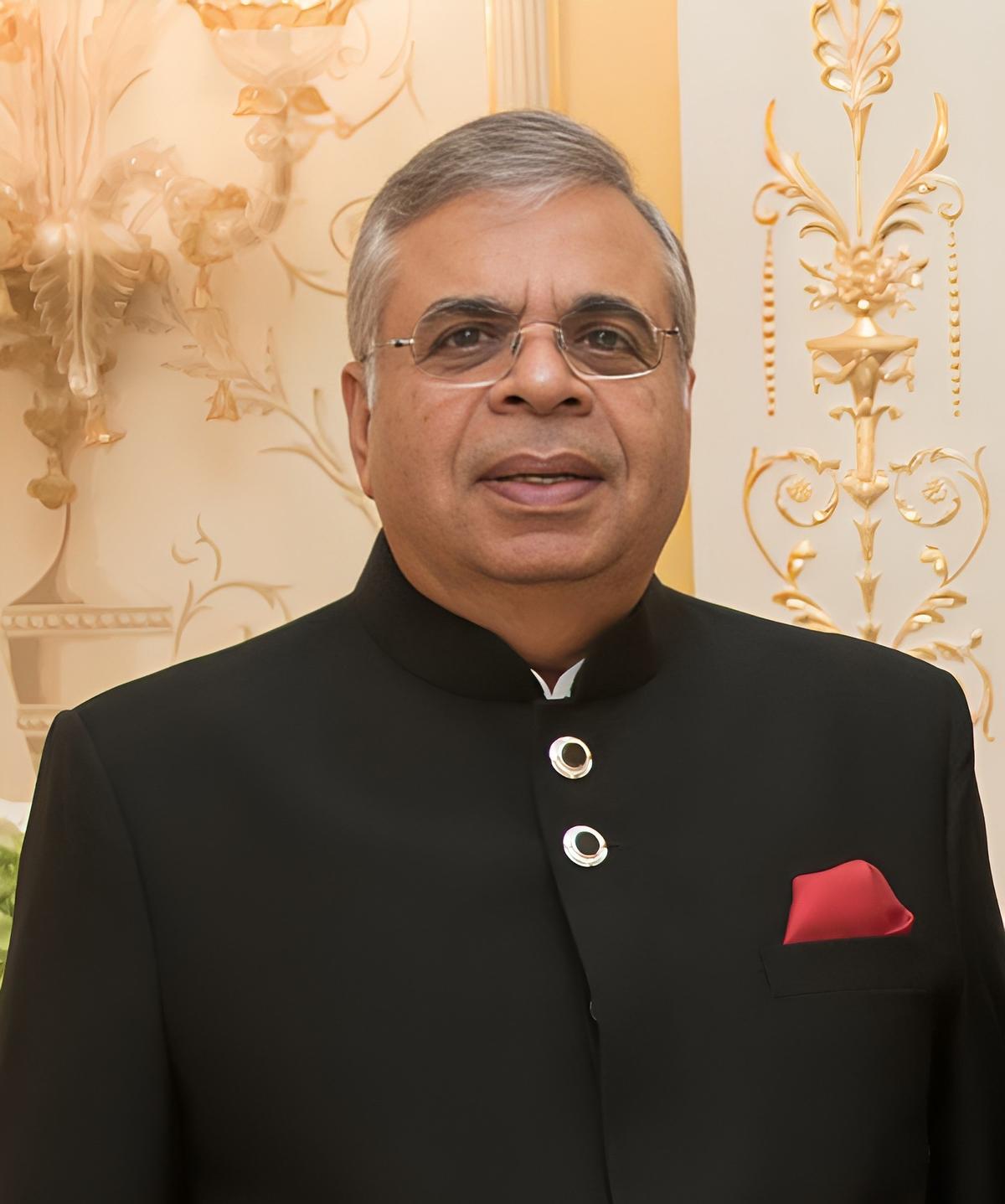

In a significant development, Ashok Hinduja, Chairman of IndusInd International Holdings Ltd (IIHL), has expressed the Hinduja Group’s readiness to infuse capital into IndusInd Bank, if needed. This assurance comes at a critical juncture as the bank faces scrutiny over recent discrepancies in its derivative portfolio, potentially impacting its net worth by over 2%. While the bank maintains a healthy capital adequacy ratio, the promoters see this as an opportune moment to reinforce confidence in the institution. A PwC audit is currently underway to investigate the issues, with stakeholders awaiting clarity on accountability and corrective measures.

Hinduja Group Willing to Infuse Capital, But No Immediate Need

Ashok Hinduja clarified that while the promoters are prepared to inject additional capital into IndusInd Bank, there is currently no immediate need for fresh funds. The bank, backed by a strong capital adequacy ratio, has not requested additional capital from its promoters.

As of now, IIHL and IndusInd, the bank’s promoters, collectively hold a 16.29% stake in the bank. However, Hinduja stated that the promoters are willing to support the bank financially to boost investor sentiment and long-term growth if such a situation arises.

Derivative Discrepancy: The Trigger Behind the Concerns

Disclosures Rock Investor Confidence

The bank’s stock took a hit last week following disclosures about discrepancies in its derivative portfolio, which could affect its net worth by over 2%. These developments have raised eyebrows among investors and market analysts, prompting a need for greater transparency.

PwC Audit in Progress

To address concerns, IndusInd Bank has appointed PwC (PricewaterhouseCoopers) as an external auditor to investigate and report on the derivative portfolio issues. Hinduja stated that the credibility of the bank hinges on the outcome of this audit report.

“Once the report comes, it will go to the board. They will review it—various committees are in place, and then they will decide who is responsible over the past several years—whether it was one person, two people, or an error, we don’t know,” Hinduja explained.

Promoter’s Move Aims to Rebuild Trust

The Hinduja Group’s willingness to infuse capital—despite no pressing need—is seen as a strategic move to restore market confidence. Market experts believe that this could signal the promoter’s commitment to long-term stability and transparency.

A Timely Opportunity for Capital Injection

According to Hinduja, the current dip in share value presents a good opportunity for the promoters to increase their stake and influence, should the need arise. It also helps the bank portray a robust image amidst ongoing scrutiny.

Conclusion

While IndusInd Bank remains financially sound on paper, the recent derivative portfolio discrepancies have cast a shadow on its credibility. The ongoing PwC audit will be a decisive factor in shaping market perception and guiding future decisions. Meanwhile, the Hinduja Group’s proactive stance on capital infusion offers a layer of assurance to stakeholders. Whether or not the capital is eventually required, the promoters’ readiness reflects a strong vote of confidence in the bank’s long-term vision. Investors and market watchers now await the audit results to gain clarity on the path ahead for IndusInd Bank.

FAQs

Q1: Why is IndusInd Bank under scrutiny?

IndusInd Bank recently disclosed discrepancies in its derivative portfolio, which could impact its net worth by over 2%. This has raised investor concerns.

Q2: What role is PwC playing in this matter?

PwC has been appointed as an external auditor to review the discrepancies and provide an independent report, which will be reviewed by the bank’s board.

Q3: Will the Hinduja Group infuse capital into the bank?

The Hinduja Group has stated they are ready to infuse capital if required, but the bank currently has no immediate need for additional capital.

Q4: How much stake do the promoters hold in IndusInd Bank?

IIHL and IndusInd, the bank’s promoters, hold a combined 16.29% stake in the bank.

Q5: When will the PwC report be released?

The exact timeline is not disclosed, but the report will first be submitted to the board for review and further action.

One thought on “IndusInd Bank Capital Infusion: Hinduja Group Ready to Step In Amid Derivative Discrepancy Concerns”