gold the timeless safe-haven asset, took a surprising hit in early April 2025 — even as global markets showed signs of economic distress. On April 4 gold price and silver price fell nearly 1%, sliding below ₹90,000 per 10 grams on the MCX, while silver dropped by over 8%. This decline came on the heels of a major global event: the announcement of former US President Donald Trump’s new “reciprocal tariffs” — a move that spooked global equity markets. But curiously, gold and silver were excluded from these tariffs. So, why did their prices still fall? Are we on the verge of a deeper correction — possibly up to 38%, as some analysts fear? And most importantly, what does this mean for you as an investor? Let’s explore the full picture.

What Triggered the Sudden Fall in Gold Prices?

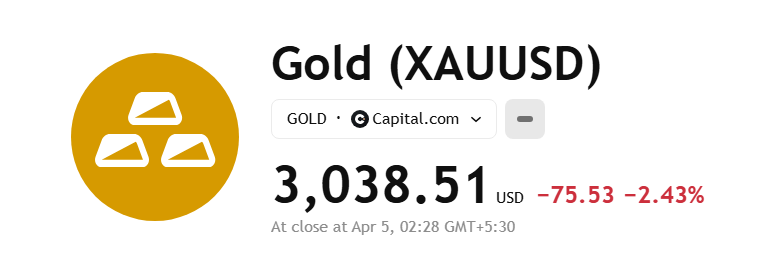

On April 4, gold prices on MCX fell to ₹89,260 before slightly recovering to ₹89,885 for the June contract. Silver saw an even steeper fall, touching a day-low drop of 2.67%. In international markets, COMEX gold dropped 1.4% to a one-week low of $3,073.5 per ounce, while silver tumbled by 8%.

Trump’s Reciprocal Tariffs Stir Global Markets

Former President Donald Trump’s announcement of new reciprocal tariffs caused panic across global financial markets. Interestingly, gold and silver were excluded from the tariffs, but that didn’t stop investors from cashing out. Why?

Profit Booking After a Strong Rally

Gold prices had rallied in recent months, fueled by recession fears, central bank buying, and geopolitical tensions. According to analysts, much of the tariff-related uncertainty was already priced in, which led investors to book profits once the news was out.

Can Gold Prices Really Decline by 38%?

Market strategist John Mills from Morningstar projected that gold could drop to $1,820 per ounce from its current level of around $3,080 — a shocking 38% potential fall.

Analysts Have Mixed Views

While Mills warns of a steep correction, other experts aren’t so sure.

Jateen Trivedi of LKP Securities believes that gold has already priced in the tariff impact, and any further decline will depend on how geopolitical events unfold.

Kaynat Chainwala from Kotak Securities points to strong gold demand from central banks and ETFs, as well as rate cut expectations, which may provide a floor to the current prices.

Key Support and Resistance Levels

On the technical side, analysts see resistance at $3,120–$3,130 for COMEX gold. Support is expected around $3,050–$3,055. A breach of this level could accelerate downside pressure in the near term.

Recent news

5 Reasons Why FII and DII Selling Could Signal Trouble for Indian Investors

FPIs Pull ₹10,355 Cr in April – Indian Investors See Buying Opportunity

What Does This Mean for Indian Investors?

Gold is a critical part of Indian household wealth and plays a central role in investment portfolios.

Buying Opportunity or Red Flag?

If gold continues to slide, it could be a great entry point for long-term investors. Lower prices benefit jewelry buyers, gold loan providers, and bullion dealers. However, if the projected 38% drop comes true, investors may need to rethink their short-term strategies.

Stay Calm, Think Long-Term

Volatility is a part of the gold market. The long-term outlook still favors gold due to the following:

- Central bank gold accumulation

- Inflation hedge qualities

- Global uncertainties like the Russia-Ukraine war and Middle East tensions

Conclusion: Should You Be Worried?

Gold’s recent dip is notable but not necessarily alarming. With major geopolitical and economic events unfolding, investors should stay calm, avoid panic selling, and consider using this correction as a strategic buying opportunity.

Always consult a certified financial advisor before making significant investment decisions — especially when the market is this volatile.

Disclaimer:

The information provided in this article is for informational purposes only. It does not constitute investment advice or financial recommendations. Investors are advised to conduct their own research or consult with a certified financial advisor before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.

One thought on “5 Shocking Reasons Gold Prices Dropped on April 4, 2025”