Introduction

In recent months, the Indian stock market has experienced a wave of FII and DII selling that has left many investors concerned about the implications for their portfolios. Additionally, data from the last week shows significant selling activity from both foreign and domestic institutional investors. Understanding why these institutional investors are selling can provide valuable insights into future market trends and help individual investors make informed decisions. This article will delve into the various reasons driving FII and DII selling and the potential impacts on the overall market, incorporating recent selling data to illustrate these trends.

The Landscape of FII and DII Selling

What are FIIs and DIIs?

Foreign Institutional Investors (FIIs) are investment bodies from outside India that allocate capital into Indian securities. They often invest in stocks and bonds, significantly influencing market movements due to the large volumes they trade. Meanwhile, Domestic Institutional Investors (DIIs) include mutual funds, insurance companies, and pension funds operating within India, contributing to the stability of the Indian capital markets.

The Importance of Institutional Investors

FIIs and DIIs are critical players in the stock market due to the sheer volume of assets they manage. Their buying and selling patterns can influence stock prices, investor sentiment, and overall market trends. As they account for a significant portion of daily trading volumes, understanding their actions can help retail investors navigate the turbulent waters of the stock market.

Recent FII and DII Selling Data (Last Week)

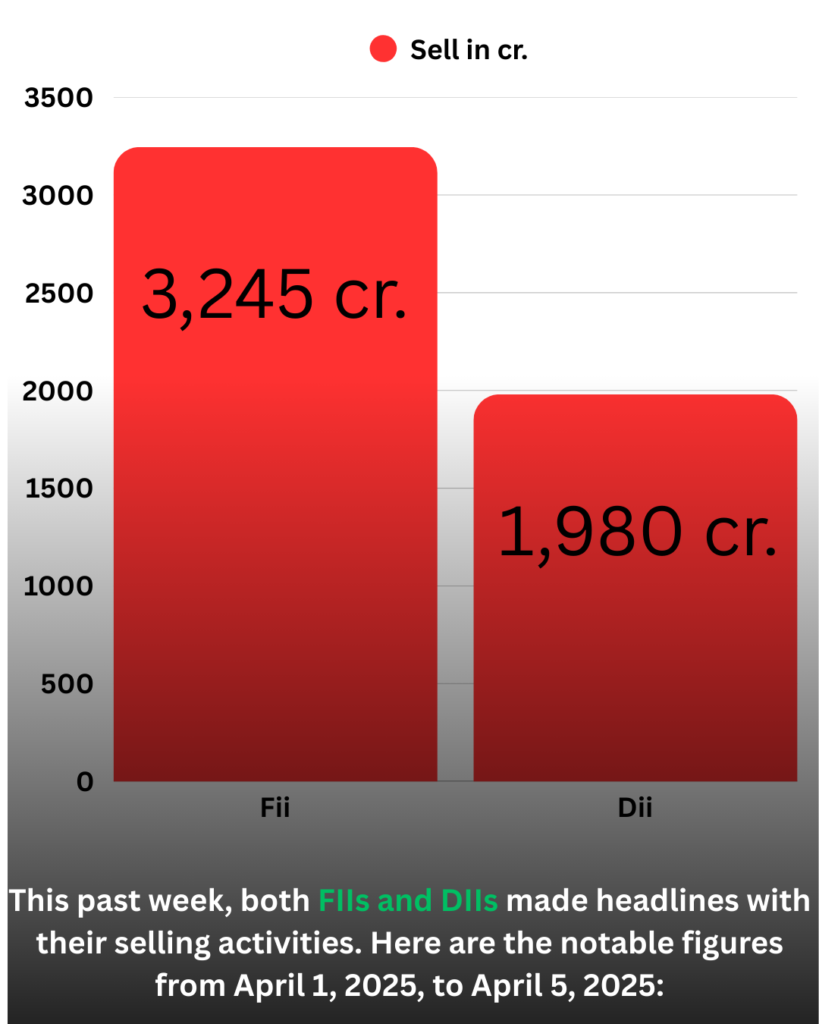

This past week, both FIIs and DIIs made headlines with their selling activities. Here are the notable figures from April 1, 2025, to April 5, 2025:

- FII Selling:

- Net Amount Sold: ₹3,245 Crores (approximately $390 million)

- Key Sectors Affected: Technology, Pharmaceuticals, and Financial Services

- DII Selling:

- Net Amount Sold: ₹1,980 Crores (approximately $240 million)

- Key Sectors Affected: Real Estate, Consumer Goods, and Infrastructure

This trend signifies a cautious approach by both foreign and domestic institutional investors as they reassess their positions within the current market context.

Also read this :-FPIs Pull ₹10,355 Cr in April – Indian Investors See Buying Opportunity

Key Reasons Behind FII and DII Selling

1. Global Economic Conditions

One of the primary drivers of FII and DII selling is the changing global economic landscape. As major economies, particularly the U.S., implement tighter monetary policies to combat inflation, global investors reassess their risk exposure. Rising interest rates often lead to capital flowing back into developed markets, reducing FII investments in emerging markets like India.

2. Geopolitical Tensions

Events such as the ongoing Russia-Ukraine conflict or geopolitical uncertainties in the Asia-Pacific region can instill fear in investors. Such tensions often lead to a cautious approach, prompting both FIIs and DIIs to withdraw from markets perceived as riskier, including India.

3. Valuation Concerns

After a prolonged bull run, many stocks in the Indian market have reached high valuations. FII and DII selling may occur as these investors engage in profit booking, selling shares to secure gains before the market potentially corrects itself. When institutional investors perceive that certain sectors are overvalued, they may opt to reallocate their investments elsewhere.

4. Domestic Economic Indicators

Economic indicators such as inflation rates, GDP growth, and unemployment levels can also influence selling behaviors among institutional investors. Recent economic data reflecting slower growth or rising inflation may prompt FIIs and DIIs to adjust their portfolios to mitigate risk.

5. Market Sentiment

Market sentiment plays a crucial role in investor behavior. Negative news, such as corporate scandals, regulatory changes, or disappointing earnings reports, can lead to increased FII and DII selling as investors seek to protect their capital from potential downturns.

Factors Impacting DII Selling

1. Profit Booking

Domestic Institutional Investors often sell to lock in profits after a period of strong market performance. After significant appreciation in stock prices, taking profits is a common strategy to avoid potential losses in case of market corrections.

2. Performance Pressure

Mutual funds and institutional portfolios are consistently evaluated based on their performance relative to benchmarks. If a DII’s funds are underperforming, managers are likely to engage in selling to improve the overall portfolio’s performance.

3. Liquidity Needs

In times of market volatility or financial strain, DIIs may face increased redemptions from investors wanting to withdraw their capital. To meet these liquidity needs, institutions must sell their holdings, contributing to the overall market selling pressure.

The Impact of FII and DII Selling on the Market

Increased Volatility

The concurrent FII and DII selling can lead to increased market volatility. When large institutional players sell, it can trigger panic among retail investors, causing a follow-the-leader mentality where retail investors also choose to sell. This can create a downward spiral, resulting in sharp declines in stock prices.

Investor Sentiment

Institutional selling can significantly affect investor sentiment. Retail investors often look to FIIs and DIIs as indicators of market health. If they observe large-scale selling, it might lead to fears of a market downturn, prompting even more selling and further depressing stock prices.

Conclusion

The selling activity by FIIs and DIIs reflects a complex interplay of global economic factors, geopolitical developments, and performance pressures. Recent data indicates a troubling trend in buyer behavior, with significant FII and DII selling potentially signaling caution ahead. Understanding these dynamics can help investors remain calm amid market volatility, allowing them to make informed decisions about their investments. While institutional selling can lead to short-term disruptions in the market, it also offers opportunities for long-term investors to acquire quality stocks at discounted prices. Maintaining a diversified portfolio and staying informed about market trends will be crucial for navigating the ever-changing landscape of investing

Introduction

2 thoughts on “5 Reasons Why FII and DII Selling Could Signal Trouble for Indian Investors”