Introduction:

In a major shakeup for India’s logistics sector, Delhivery has announced the acquisition of rival Ecom Express for ₹1,407 crore. The move marks a significant turning point in the third-party logistics (3PL) space, where high competition, shrinking e-commerce margins, and rising operational costs have put companies under intense pressure. This acquisition is being widely seen as a distress sale for Ecom Express, which had once aimed for a ₹7,300 crore IPO valuation just last year. As the industry grapples with slower shipment growth and a surge in quick-commerce, Delhivery’s strategic play may redefine how India’s logistics game is played. This article breaks down the key reasons behind the deal, what it signals for the industry, and who stands to gain—or lose—from this high-stakes consolidation.

Ecom Express: From IPO Dreams to Distress Deal

Once a Leader in E-Commerce Logistics

Ecom Express was once a rising star in India’s B2C logistics market. The company had filed a draft red herring prospectus (DRHP) in August 2023 with plans to go public at a valuation of ₹7,300 crore. However, FY24 proved to be turbulent.

Its shipment volumes rose by just 10%, revenue growth nearly stagnated at 2% (₹2,609 crore), and net losses widened to ₹255 crore. A major blow came when Meesho, Ecom’s biggest client, shifted to its own in-house logistics arm—Valmo. Ecom Express

“Over-reliance on a single client is always risky. When the dynamics shift, there’s little room to recover,” said Satish Meena, advisor at Datum Intelligence.

Delhivery’s Strategic Advantage

Profitability Amid a Tough Market

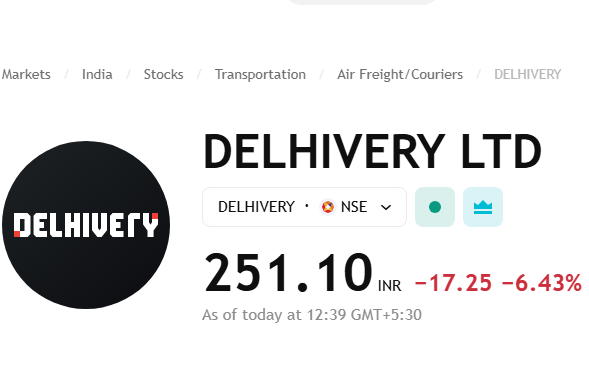

While Ecom struggled, Delhivery maintained steady momentum. It reported ₹8,142 crore in revenue in FY24 and narrowed its losses to ₹249 crore. Even more impressive, it turned profitable in Q1 FY25—a rare feat in the logistics space.

Access to Tier-3 and Tier-4 Markets

Through this acquisition, Delhivery gains access to Ecom’s infrastructure, particularly in Tier-3 and Tier-4 towns. These regions are fast becoming hotspots for social commerce platforms like Meesho and DealShare, where delivery reach is critical.

This move not only strengthens Delhivery’s rural presence but also improves its economies of scale at a time when margins are razor-thin.Ecom Express

What This Means for India’s 3PL Sector

Consolidation is the Only Way Forward

India’s 3PL space is overcrowded. With e-commerce shipment volume growth slowing from 30–40% annually to just 10–15%, there simply isn’t room for many big players.

“There isn’t space for multiple large players. Consolidation is bound to accelerate,” Meena noted.

The rise of quick commerce (q-commerce) has also reduced the order volumes available for traditional 3PLs, as grocery and small-ticket items now bypass regular logistics networks.

Distressed Valuations May Lead to Market Correction

A report from Emkay Global noted that irrational pricing by heavily funded logistics startups has long hurt sector profitability. But distress deals like this could force the industry to adopt more sustainable pricing models, firming up margins.

Challenges Ahead for Competitors

Blue Dart, DTDC Feel the Heat

Delhivery’s bold move puts pressure on players like Blue Dart and DTDC to adapt. The market is maturing quickly, and survival will depend not just on scale but also on capital efficiency, client diversification, and deep tech integration.

Recent news

5 Powerful Reasons Sridhar Vembu Urges India to Import Used Machines

5 Alarming Reasons Why Piyush Goyal Slams China’s Unfair Trade

Investors are also cautious now, with IPO markets offering limited support and capital becoming scarce. Only the most resilient and innovative logistics firms will survive the next phase of market evolution.

Conclusion: A New Era for Indian Logistics

Delhivery’s acquisition of Ecom Express is more than just a business transaction—it’s a loud message to the logistics industry. The era of hyper-growth is over; now it’s about strategy, reach, and resilience. As consolidation accelerates, we may see more deals unfold, reshaping India’s logistics backbone for a post-e-commerce boom world.

Disclaimer: The information provided on MoneyFlowInsight.com is for informational and educational purposes only. We do not provide any investment, trading, or financial advice. While we strive to provide accurate and up-to-date content, Money Flow Insight and its team are not liable for any losses or damages arising from the use of this website. Always consult a certified financial advisor before making investment decisions.

MoneyFlowInsight.com is a news and analysis platform and is not registered with SEBI or any other regulatory authority in India.

One thought on “Ecom Express’s Fall: From IPO Ambitions to a Distress Sale:2025”