Introduction

In a dramatic escalation of economic tensions, U.S. President Donald Trump has imposed a staggering 145% tariff on Chinese imports, intensifying the ongoing trade war between the world’s two largest economies. The tariff surge, confirmed by a White House official and reported by CNBC and Bloomberg, represents a significant jump from the previous 84%, incorporating a new 20% levy attributed to China’s alleged involvement in fentanyl trafficking.

This aggressive move is likely to fuel inflationary pressures, disrupt global supply chains, and shake investor confidence. As Washington and Beijing dig in their heels, markets are bracing for more volatility. Meanwhile, businesses reliant on cross-border trade are calling for clearer policies amid the confusion triggered by uneven tariff implementation.

Tariff Hike to 145%: A Historic Economic Move

President Trump’s new executive order raises tariffs from 84% to a jaw-dropping 125%, with an additional 20% penalty imposed on Chinese goods over alleged fentanyl trafficking activities. This puts the total levy at 145%, the highest ever seen in this bilateral trade conflict.

The administration claims the hike is essential to protect U.S. manufacturing and national security. Critics argue it will raise prices for American consumers and trigger further retaliation from China.

Ripple Effects on Global Markets and Supply Chains

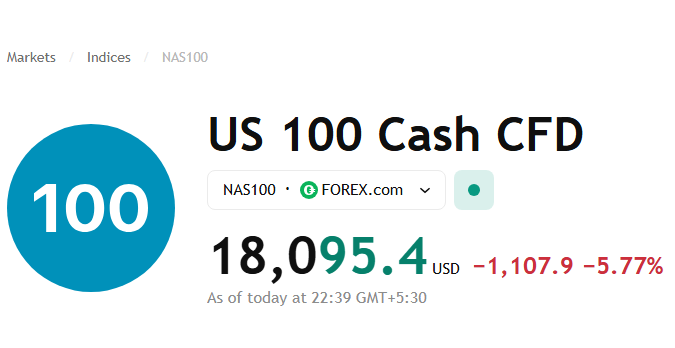

Global markets reacted with immediate volatility. Wall Street saw a sharp drop in early trading, while Asian indices closed lower. The tariff escalation has injected fresh uncertainty into already fragile global supply chains, particularly in tech, automotive, and pharmaceuticals.

Businesses that rely on Chinese components are now scrambling to adjust sourcing strategies, with many warning of inevitable cost increases that may soon be passed on to consumers.

China’s Response: Retaliation or Negotiation?

China’s Ministry of Commerce called the move “unilateral bullying” and hinted at “countermeasures” to defend its economic interests. Analysts expect China to respond either through counter-tariffs, currency devaluation, or stricter regulatory actions against U.S. firms operating in China.

However, some insiders suggest Beijing may also seek to reopen talks, fearing broader economic damage if the standoff continues unchecked. trump

Confusion Over Tariff Policy Implementation

Trump’s tariff rollout has been marred by inconsistent application across nations. While China faces the highest rates, tariffs on other trade partners were reportedly postponed. This uneven approach has confused international businesses and led to lobbying by various industries for clarity and exemptions.

trump Analysts warn that such inconsistency could undermine U.S. credibility in global trade negotiations.

Recent news

India Likely to Sign Partial US Trade Deal in 90 Days

Trump Hits China with 125% Tariffs, MarkeFast

Trump Announces 90-Day Tariff Pause for All Countries Except China: Markets Soar Amid Trade Shift

Impact on U.S. Consumers and Businesses

Economists warn that American consumers will likely bear the brunt of this move, especially on electronics, clothing, and household goods sourced from China. The tariff costs are expected to filter down to retail prices, leading to potential inflation in key consumer segments.

Small and medium enterprises (SMEs) that depend heavily on Chinese imports may face existential threats, with some already considering layoffs or shutdowns. trump

Geopolitical Implications Beyond Trade

While the tariffs are primarily economic, they carry significant geopolitical weight. Tensions between the U.S. and China now span technology, national security, and international influence—from TikTok bans to semiconductor restrictions.

The fentanyl-related tariffs indicate that U.S. trade policy is increasingly being used as a tool of foreign policy, setting a precedent that could shape future global interactions.

Conclusion: A Critical Turning Point

trump The 145% tariff marks a critical turning point in U.S.-China relations. As both nations brace for the fallout, the world watches with growing concern. Whether this bold move results in meaningful change or spirals into economic chaos remains to be seen. What’s clear is that the global economy is entering uncharted territory—and stability is far from guaranteed.

Disclaimer:

The information presented in this article is for general informational purposes only. Money Flow Insight does not provide investment, tax, or legal advice. All views and data are based on publicly available sources as of the article’s publication date and are subject to change. Readers are advised to consult with a qualified financial advisor before making any investment or business decisions.

One thought on “Trump Unleashes Devastating 145% Tariff on Chinese Goods, Deepening US-China Trade War”