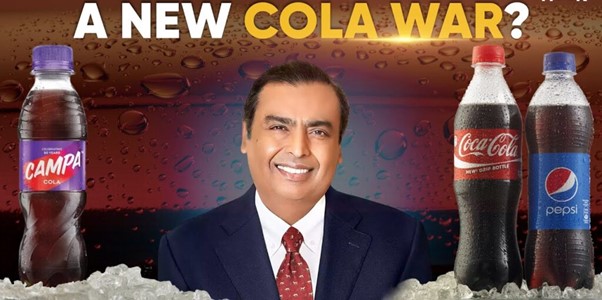

Campa Cola Faces Stiff Competition: Coca-Cola & Pepsi Join Rs 10 Price War

The Indian beverage market is witnessing a major shake-up as Campa Cola, owned by Mukesh Ambani-led Reliance Industries, is now facing fierce competition from global beverage giants Coca-Cola and PepsiCo. With both multinationals launching their budget-friendly drinks priced at Rs 10, a new price war has erupted in India’s rapidly expanding FMCG sector.

After relaunching Campa Cola in 2023, Reliance Consumer Products Limited (RCPL), the FMCG arm of Reliance, has been aggressively capturing market share. But with Coke and Pepsi entering the Rs 10 segment, the competition is bound to get tougher.

Rs 10 Price Segment: The New Battleground

Coca-Cola and PepsiCo Launch Low-Cost Variants

As per an Economic Times report, Coca-Cola has introduced Thums Up X Force, Coke Zero, and Sprite Zero, while PepsiCo has launched Pepsi No-Sugar in 200 ml bottles, all priced at just Rs 10. This is the first time these beverage giants have entered this price segment in India—a strategic shift aimed at countering Reliance’s growing influence.

This move marks a significant change in the pricing dynamics of India’s beverage market, where previously, such brands commanded premium prices.

also, read this :-RVNL Secures Rs 5546 Crore NHAI Project: Order Book Surges to Rs 97,000 Crore

Reliance’s Campa Cola Strategy: Diversification & Affordability

New Product Launches in Rs 10 Category

Reliance isn’t banking solely on Campa Cola. The conglomerate has expanded its product lineup in the Rs 10 price category:

- Spinner Sports Drink – Co-created with legendary cricketer Muttiah Muralitharan

- RasKik Gluco Energy Drink – Launched in January 2025

These additions reflect Reliance’s strategy to dominate the low-cost beverage market, especially in Tier 2 and Tier 3 cities where affordability is a key factor.

International Expansion

In February 2025, RCPL also launched Campa Cola in the UAE, marking its first foray into international markets. This move not only broadens the brand’s global footprint but also strengthens Reliance’s ambitions in the FMCG sector.

India’s Beverage Market: Huge Growth Potential

A report by ICRIER estimates that India’s beverages market, valued at Rs 67,100 crore in 2019, is expected to reach Rs 1.47 trillion by 2030. With such exponential growth prospects, it’s no surprise that beverage titans are eyeing a bigger share of the pie.

From legacy brands to new entrants, everyone is aiming to win consumer preference through price, innovation, and distribution reach.

Why Global Giants Are Adopting New Strategies

According to industry experts, Coca-Cola and PepsiCo’s Rs 10 launches are not just competitive responses but also a way to test the Indian price-sensitive market without disturbing their flagship brand pricing. A senior industry insider was quoted saying that these companies are in a “wait-and-watch mode” before implementing national price reductions.

Conclusion: Who Will Win the Rs 10 Beverage War?

With Campa Cola’s rising presence, PepsiCo and Coca-Cola’s strategic moves, and an expanding FMCG ecosystem, the Rs 10 beverage segment is heating up. Reliance’s diversification and distribution network give it a strong edge, but the global giants’ brand recall and innovation could reshape market dynamics.

The battle for the budget-conscious consumer is just beginning, and it will be interesting to see which brand quenches India’s thirst for value and taste.

FAQs

Q1. What is the current price war in the Indian beverage market?

A new Rs 10 price war has emerged, with Campa Cola, Coca-Cola, and PepsiCo offering low-cost drinks to capture the mass market.

Q2. What new products has Reliance launched in this segment?

Reliance launched Campa Cola, Spinner Sports Drink, and RasKik Gluco Energy, all priced at Rs 10.

Q3. What are Coca-Cola and PepsiCo offering at Rs 10?

Coca-Cola launched Coke Zero, Sprite Zero, and Thums Up X Force, while PepsiCo launched Pepsi No-Sugar 200 ml bottles at Rs 10.

Q4. What is the market size of India’s beverage industry?

The market was Rs 67,100 crore in 2019 and is expected to reach Rs 1.47 trillion by 2030, as per ICRIER.

Q5. Is Campa Cola available internationally?

Yes, Reliance launched Campa Cola in the UAE in February 2025, marking its global expansion.

Disclaimer:

This article is for informational purposes only and does not constitute investment advice or brand endorsement. Readers are encouraged to do their own research before forming opinions or making decisions.

One thought on “Campa Cola vs Coke & Pepsi: Beverage Price War at Rs 10 Intensifies in Indian Market”