Introduction

Indian stock markets witnessed a bloodbath on Monday, April 7, 2025, as panic gripped global financial markets over the intensifying US-China trade war. The benchmark BSE Sensex tumbled over 2,800 points while Nifty 50 cracked by more than 900 points in early trade. Market sentiment was shaken by US President Donald Trump’s aggressive tariff stance, with investors fearing a full-blown global trade conflict. The sell-off was further worsened by massive foreign institutional selling, rising volatility, and technical breakdowns on the charts. Here’s a detailed look at what caused this crash and what investors should know.

Markets in Deep Red: Key Highlights

Sensex, Nifty Tank Amid Global Meltdown

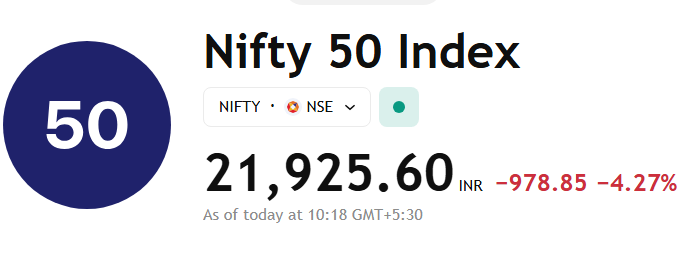

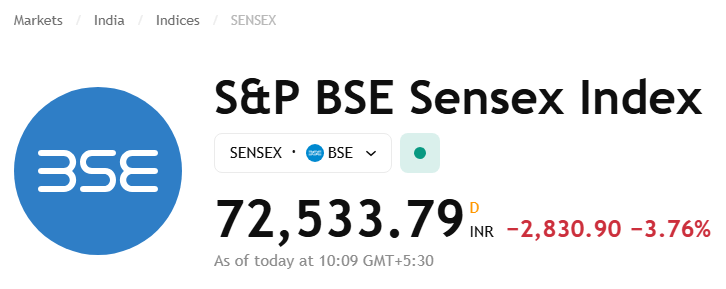

By 10:00 AM, the BSE Sensex had plummeted 2,816.80 points, or 3.74%, to 72,547.89, while the Nifty 50 sank 919.95 points, or 4.02%, to 21,984.50. This sharp fall marked one of the worst starts to a trading week since the Covid-19 pandemic era.

The fall comes on the back of a sharp decline in Wall Street futures, which dropped around 4% on Sunday. Meanwhile, Asian markets also posted deep losses ranging from 4% to 8%, reacting to escalating geopolitical tensions and tariff wars.

What Triggered This Market Crash?

Trump’s Tariff Turmoil Shakes Global Confidence

President Trump’s renewed push for aggressive tariffs on Chinese and other foreign imports has reignited fears of a global trade war. Trump stated that there would be no deal with China unless the US trade deficit was addressed, sending shockwaves across global markets.

China Retaliates: Markets Brace for Impact

In a swift response, China announced retaliatory tariffs, further fueling investor panic. Beijing’s statement noted that its countermeasures had already been reflected in market behavior, leaving investors speculating about the severity of future actions.

Expert Views: Nifty Breakdown, Support & Resistance Zones

Bearish Continuation Confirmed

According to Dhupesh Dhameja, Derivatives Analyst at SAMCO Securities, Nifty has clearly broken crucial support levels, confirming a bearish continuation pattern.

“The 23,000–23,200 range has now flipped from a strong support zone into a major resistance ceiling,” he said. “The next key support lies between 22,800–22,500. A clean break below 22,800 could accelerate unwinding.”

Until Nifty decisively moves back above 23,000, market rallies are expected to be sold into, Dhameja added.

Recent news

5 Shocking Reasons Gold Prices Dropped on April 4, 2025

5 Reasons Why FII and DII Selling Could Signal Trouble for Indian Investors

Other Market Movers: IPO, Currency & Crypto

Retaggio Industries IPO Debuts on Turbulent Day

Despite market conditions, Retaggio Industries IPO (BSE SME) listed on the bourses today. However, the listing sentiment was subdued amid the broader sell-off.

Rupee Tumbles to 2-Month Low

The Indian Rupee opened 41 paise lower at 85.65, marking its weakest start in two months, driven by worsening trade tensions and foreign outflows. This comes after the rupee had gained 2.3% in March.

Bitcoin Dips Below $80,000

The crypto market wasn’t spared either. Bitcoin slipped below $80,000, reacting to the same macroeconomic triggers. Analysts believe crypto volatility may rise further if uncertainty lingers.

What Should Investors Do Now?

Wait-and-Watch Is the Best Strategy

According to Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, the current phase is marked by extreme uncertainty, and the best course is to wait and watch.

“India’s exports to the US form just 2% of its GDP, so the impact on long-term growth should be limited. Sectors like pharma, digital platforms, cement, aviation, and defence may emerge stronger,” he stated.

Domestic Demand to Support Certain Sectors

Segments less exposed to exports, particularly those driven by domestic consumption, are expected to remain resilient. Pharmaceuticals may escape US tariffs, adding to their defensive appeal.

Conclusion

The April 7, 2025, stock market crash underscores the fragile state of global financial markets amid rising geopolitical tensions. While the short-term outlook remains volatile, long-term investors are advised to stay calm, avoid panic selling, and focus on fundamentally strong sectors. With the Indian economy relatively insulated from direct tariff impacts, the road ahead, though bumpy, may not be as bleak as it appears today.

Disclaimer

The content on Money Flow Insight is for informational purposes only and should not be considered financial or investment advice. We do not guarantee the accuracy or completeness of any information provided. Always consult a qualified financial advisor before making investment decisions. Use of this site is at your own risk.