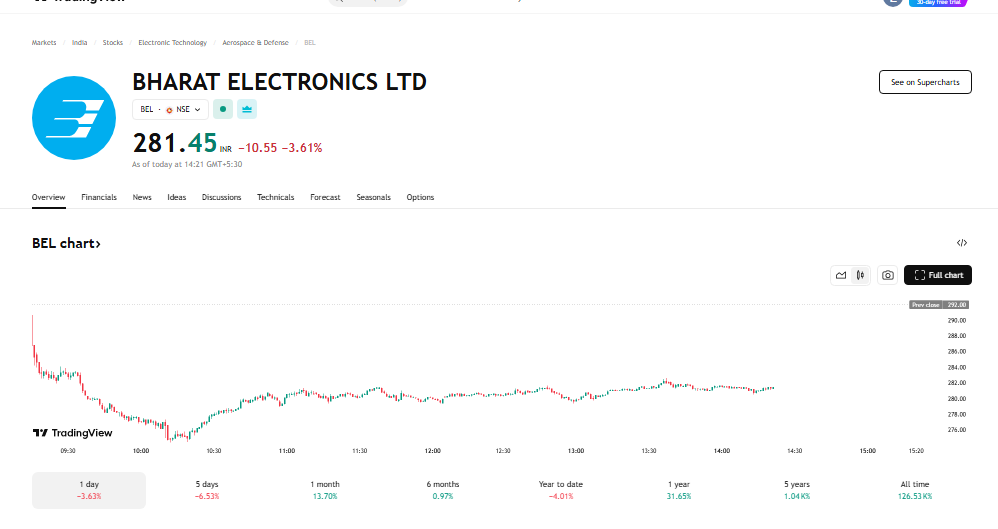

BEL Share Price Drops Over 5% Following Turnover Announcement

BEL Share Price of Bharat Electronics Ltd (BEL) witnessed a sharp decline of over 5% on April 2, following the company’s announcement of its annual turnover for the financial year 2024-25. The state-owned defence public sector undertaking (PSU) reported a turnover of approximately Rs 23,000 crore, marking a 16% growth from the previous year’s Rs 19,820 crore. However, this figure fell short of BEL’s internal target of Rs 25,000 crore, leading to a negative market reaction.

At 10:10 AM on April 2, BEL share price was trading at Rs 276.6 per share on the Bombay Stock Exchange (BSE), reflecting a decline of 5.3%. The stock has seen a 52-week high of Rs 240.5 and a low of Rs 212.6. The company’s market capitalization currently stands at Rs 2.02 lakh crore.

BEL Share Price Impact and Financial Performance

According to BEL’s stock exchange filing, the company registered export sales of approximately $106 million during FY 2024-25, compared to $92.98 million in the previous fiscal year, showing a 14% growth. Additionally, BEL secured new orders worth Rs 18,715 crore in FY 2024-25. Some of the significant orders acquired during this period include:

- BMP II Upgrade

- Ashwini Radar

- Software Defined Radios

- Data Link

- Multi-Function Radars

- EON 51

- Seekers

- Anti-Drone System

- Airport Surveillance Radar

- Sonar Upgradation

- Flycatcher Spares

- Radar Upgradation

- Spares and Services

- Non-defence sector projects

As of April 1, 2025, BEL’s total order book stands at approximately Rs 71,650 crore, including an export order book worth $359 million.

BEL Share Price Outlook and Strategic Growth Initiatives

BEL’s Chairman & Managing Director, Manoj Jain, expressed confidence in the company’s long-term growth trajectory. He highlighted BEL’s commitment to self-reliance through increased indigenisation efforts, modernisation, and outsourcing to Indian industries, including MSMEs and start-ups.

Additionally, BEL is actively working on expanding its global presence and strengthening its footprint in international markets. The company has rolled out strategies to enhance its outreach, ensuring its continued leadership in the strategic electronics sector.

To achieve its long-term goals, BEL is focusing on increasing research and development investments and forming strategic collaborations with both domestic and international partners. The company aims to enhance its production capabilities, ensuring that it remains competitive in the rapidly evolving defence electronics sector.

Moreover, BEL is venturing into emerging technologies such as artificial intelligence, cybersecurity, and advanced radar systems, which are expected to play a crucial role in strengthening its position in the global market. The company is also actively engaging with global defence agencies to secure new contracts that will contribute to its future growth.

5 Key Reasons Bernstein Downgrades Waaree Energies & Premier Energies: Here’s Why

BEL Share Price Forecast and Market Sentiment

While BEL’s turnover growth of 16% is commendable, the shortfall in meeting its projected revenue target has impacted investor sentiment. However, the company’s robust order book and its focus on technological advancements and market expansion position it well for future growth. Investors will closely monitor BEL’s execution of its strategic initiatives and its ability to secure and deliver new contracts in the coming quarters.

Market analysts believe that BEL’s strong order pipeline and its expanding international footprint will help it recover from the recent stock decline. Additionally, government initiatives aimed at strengthening domestic defence manufacturing could further boost BEL’s revenue prospects in the coming years.

As the company continues to focus on innovation and operational efficiency, investors will be looking for consistent growth in earnings and order inflows. BEL’s ability to execute its orders efficiently and meet future revenue targets will play a crucial role in determining its stock performance in the long run.

Conclusion

Despite the recent decline in BEL share price, the company remains a key player in India’s defence sector. Its strong order book, commitment to technological advancements, and expansion into international markets position it well for future growth. Investors and market analysts will closely watch the company’s next moves as it strives to achieve its long-term goals. With continued government support and strategic investments, BEL has the potential to regain investor confidence and strengthen its market position in the coming years.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. MoneyFlowInsight does not take responsibility for any investment decisions based on this content. Readers are advised to conduct their own research before making any financial decisions.

One thought on “BEL Share Price Falls 5% as Rs 23,000 Crore Turnover Misses Target”