13 May 2025 Tuesday

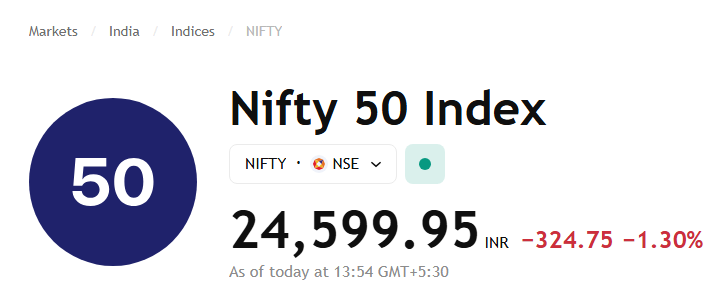

The Indian stock market is witnessing a huge decline. On Tuesday, the benchmark index Sensex and Nifty fell by more than 1%. On Monday, after reports of a fragile ceasefire with Pakistan, the stock market saw a big surge, but today is proving to be a negative day for investors. The Sensex has fallen 1,258 points to 81,171, and the Nifty has fallen 327 points to 24,597.

Let us know about the five main reasons due to which there has been such a decline in the stock market today.

1.Decline in demand and global economic concerns

The biggest reason for today’s decline is the fluctuations in the global economic situation and especially the decline in demand. Many leading economists have warned that the global growth rate may slow down, which may also put pressure on developing economies like India. This has led to a wave of selling in the stock. Especially the shares of those companies which are dependent on exports have fallen.

2.Pressure in banking and financial sector

India’s banking and financial sector is witnessing a big decline today. Especially the shares of those companies which are related to banking and financial services have declined. Investors believe that rising interest rates and economic uncertainties can create problems for these companies. Due to this, the entire market has been negatively affected.

3.Expensive oil prices

The rise in prices of petroleum products has affected the Indian market. Rising crude oil prices lead to expensive production costs, which puts pressure on the profits of companies. This has led to a decline in the energy sector and other sensitive sectors. Additionally, rising prices of petroleum products also affect the spending capacity of consumers, which has had a negative impact on the stock.

4.Domestic and global political instability

Any tension between India and Pakistan leads to volatility in the stock market. Political instability and trade tensions can make global investors cautious, leading to a wave of selling in the market. Upcoming political elections in India and global economic tensions can lead to a loss of investor confidence, which pulls the downwards.

5.Effects of US-China trade war

The ongoing trade war between the US and China is affecting the global market, and its direct impact is also visible on the Indian stock market. The global trade slowdown can also affect the economy of developing countries like India, due to which investors become cautious and selling starts in the stock market.

Advice for investors: Opportunity is hidden in the fall

Whenever there is a huge fall in the stock market, many investors panic and sell their investments without thinking. But history is witness that after every big fall in the market, there is a new boom. In such a situation, this is not the time to panic but to act with patience and discretion.

Investors should look at the market as a long-term journey, in which fluctuations are a natural part. During the fall, the shares of strong companies are available at lower prices, which have the potential to give better returns in the future. At this time, the shares which you were hesitant to buy earlier, can now be available at a discount.

Some important things that investors should keep in mind:

- Adopt a long-term mindset

To succeed in the stock market, it is important that you invest keeping in mind a time frame of at least 3-5 years. Do not get distracted by short-term fluctuations. - Choose quality companies

Invest in businesses that have a good track record, strong management and have the strength to compete in the market. - Focus on value investing

If a stock is trading below its fair value and its fundamentals are good, then it may be suitable to buy during the fall. - Make SIP and phased investments

Given the volatility in the market, it would be wise to make SIP (Systematic Investment Plan) or phased investments instead of lump sum investments. - Keep diversification

Do not invest money in only one sector or company. Divide your portfolio into different sectors and asset classes so that the risk remains balanced. - Analyze and research

Before investing in any stock, do a thorough analysis of it—such as the company’s balance sheet, earnings prospects, loan status, and market trends

Outcome

The decline seen in the market today is the result of global and domestic reasons. However, this decline can happen for some time, and investors need not panic. If you invest wisely, you can also benefit from market volatility.

Therefore, focusing on long-term investment and fundamentals can be the best option at this time.

Conclusion: Instead of panicking about the decline in the stock market, we should understand these changes and adopt the right strategy. Investment decisions should be made based on your investment objective and time horizon.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information