Jeff Bezos, the founder of Amazon and one of the richest people in the world, is once again in the news. This time the reason is his new share sale plan, under which he is going to sell 25 million shares of Amazon. According to the current share price, this deal will be worth about $ 4.8 billion. This move comes at a time when the company has warned of a possible reduction in profits in its quarterly results.

What is Bezos’s 10b5-1 trading plan?

Jeff Bezos adopted a “10b5-1 trading plan” on March 4, 2025, which is a legitimate way to avoid insider trading under US law. According to this plan, he will be able to gradually sell these shares by May 29, 2026. The 10b5-1 plan allows top executives of companies to sell shares in a stipulated time, under pre-determined rules, so that transparency is maintained in the market.

Why is Jeff Bezos selling so many shares?

- Diversification: Most of Bezos’ personal investments are still in Amazon. By selling shares on such a large scale, he can diversify his portfolio.

- Philanthropy and personal projects: Jeff Bezos has invested heavily in Earth Fund, Blue Origin and other social works in recent years. This sale can also be for the fulfillment of those projects.

- Tax Planning: Tax strategy also plays an important role in such big transactions.

Amazon’s quarterly results and business conditions

Amazon has said in its latest quarterly report that the company’s operating profit may be less than expected. The company has given several important reasons behind this:

- Tariff and trade policies: President Donald Trump’s tariff policies in the US have directly affected Amazon’s business. Increased taxes on products coming from China and other countries have increased the cost.

- Recession Fears: Due to global economic slowdown, consumer spending is declining, which may affect online shopping.

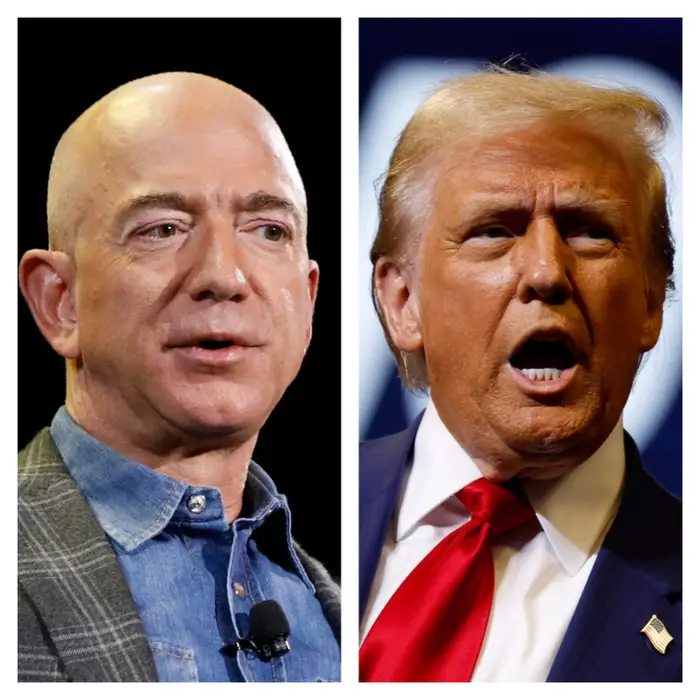

Tension between Trump and Bezos

President Trump and Bezos have already been at loggerheads, especially because of the Washington Post (which is Bezos’s personal property). Recently, Amazon had decided that it would inform American customers about the tariffs on the products, so that consumers would know the real reason for the price increase. Trump called Bezos directly and expressed his displeasure over this move. After this, Amazon announced that it would not display this information.

What does this mean for investors?

On hearing the news of Bezos selling shares, it is natural for many investors to question whether this is a warning bell for Amazon’s future. But according to experts:

- This is routine selling: This is a regular process under the 10b5-1 plan and it does not give any negative indication on the condition of the company.

- Bezos is no longer the CEO: Andy Jassy is the new CEO of the company. Bezos is no longer directly involved in the day-to-day operations of the company.

- Advance information to the market: Since this information is provided through public filings, it is not considered insider trading.

Company’s long-term strategy

Amazon is no longer just an e-commerce company, but it is expanding rapidly in areas such as AI, cloud computing (AWS), healthcare, and logistics. Although there are short-term pressures, the company has great potential from a long-term perspective.

Conclusion

Jeff Bezos’s share sale is a strategic and pre-planned decision. Although current economic pressures and business policies have affected Amazon’s immediate situation, this move does not signal investors to panic. Bezos’ share sale may be part of his personal investment and social projects.

FAQs

Q1: Is Jeff Bezos the CEO?

No, Jeff Bezos is no longer the CEO of Amazon. Andy Jassy is the current CEO.

Q2: Will Bezos’ share sale affect Amazon’s share price?

The chances are low as it is being done under a pre-planned and legal framework.

Q3: Is the company in financial trouble?

No, the company is making profits, but in some quarters the profits may be less than expected.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information.