In today’s world, whenever we talk about bonds investment, the names of stock market, mutual funds and real estate come first. But there is also an investment option which many people ignore, even though it can be safe, stable and give regular returns. We are talking about bond.

What is a bond?

A bond is a type of loan that you give to the government or a company. In return, they pay you interest over a period of time and eventually return your principal.

In simple words –

“When you buy a bond, you are lending money, and the issuer of the bond promises to return it with interest.”

How do bonds work?

Suppose the government issues a bond of ₹10,000 at 7% annual interest rate, with a tenure of 5 yearr If you buy this bond, then:

- Every year you will get ₹700 interest

- After 5 years you will get back ₹10,000 as principal

Bonds are for a fixed tenure, and they pay interest to the investor every year or every six months

Who issues bonds?

- Government – like Government of India or State Governments (G-Sec, T-Bills)

- Government organizations – like NHAI, PFC, NABARD

- Private companies – Corporate Bonds

- Banks and financial institutions

Types of bond

| Government bond | |

| Corporate bond | Companies issue these to raise capital. The risk is slightly higher, but the interest is also higher. |

| Tax-free bond | The interest on these is tax-free, such as NHAI and PFC bonds. |

| Municipal bond | Issued by local bodies (such as municipal corporations), usually for infrastructure projects. |

| Convertible | Convertible: Can be converted into shares later |

| non-convertible bond | Non-convertible: Can not be converted into shares |

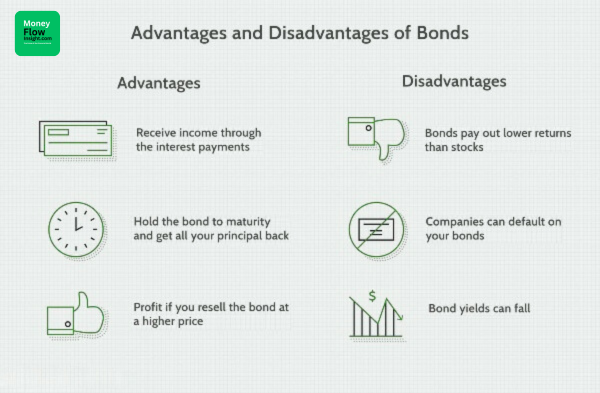

Benefits of Investing in Bond

- Stable Income

Bonds provide regular income at a fixed interest rate.

- Lower Risk

Bond are considered less risky than the stock market, especially government bonds.

- Diversification

Makes the portfolio diversified, which reduces the risk.

- Tax Benefits

Interest received on some bonds such as Tax-Free Bond is outside the scope of tax.

Risks Involved in Bond

Interest Rate Risk

If interest rates rise, the value of your old bond may fall.

Credit Risk

If the bond issuer defaults, the investor may suffer a loss.

Liquidity Risk

Some bonds may be difficult to sell immediately in the market.

How do you get returns on bond?

- Coupon Rate – Interest at fixed time

- Capital Gain – If you bought at a low price and sold at a higher price

- Return – of principal on maturity

Where can I buy bond in India?

RBI Retail Direct Portal (for Government bonds)

Stock Exchanges (NSE/BSE)

Mutual Funds – Debt Funds

Banks and NBFCs

Bond Brokers / Online platforms – like Zerodha, Groww etc

What is the difference between bond and shares?

| Measure | Bonds | Shares |

| Risk | Low | High |

| Return | Stable | Uncertain |

| Ownership | No | Yes |

| Income Source | Interest | Dividend + Share Price |

| Market volatility | Low Impact | High Impact |

Who should invest in bond?

- People who want safe and regular income

- Retired individuals or investors who want protection of capital

- Investors who want balance in their portfolio

What is the rating of a bond?

Bonds are rated by credit rating agencies such as CRISIL, ICRA, CARE etc.:

- AAA – Safest

- AA/A – Low risk

- BBB or below – High risk

Always check the rating of a bond before investing in it.

Relationship between RBI and bond market

RBI controls the monetary policy of the country and when it conducts Open Market Operations (OMO) i.e. buys or sells government bond, the liquidity in the market increases or decreases. This affects the interest rate and bond prices.

RBI has announced ₹15 billion OMO in 2025, due to which the bond market is seeing a boom. This indicates that RBI wants to stimulate economic activity.

Tips for smart investors

- Never invest all your capital in bonds – diversify

- Invest only in well-rated bonds

- Keep maturity and interest rate in mind

- Be sure to understand tax impact

- Check liquidity while buying in the secondary market

Conclusion

Bond are an investment option that can provide you with safe and stable income, especially when there is uncertainty in the market. You can build a good fixed income portfolio with bonds issued by the government and corporate entities.

However, before investing, do check the points like rating, duration, interest rate and liquidity of the bond. And most importantly – consult your financial advisor before making any investment.

Disclaimer: This article is for informational purposes only. Consult a certified financial advisor before investing. MoneyFlowInsight does not take responsibility for any investment decision based on this information.