In a remarkable turn of events, the combined Market Cap of India’s top 10 most valued firms surged by an astounding ₹3.84 lakh crore in a holiday-shortened week. This impressive growth was mainly driven by a strong rally in the equity markets, with HDFC Bank and Bharti Airtel emerging as the biggest gainers among the leading performers.

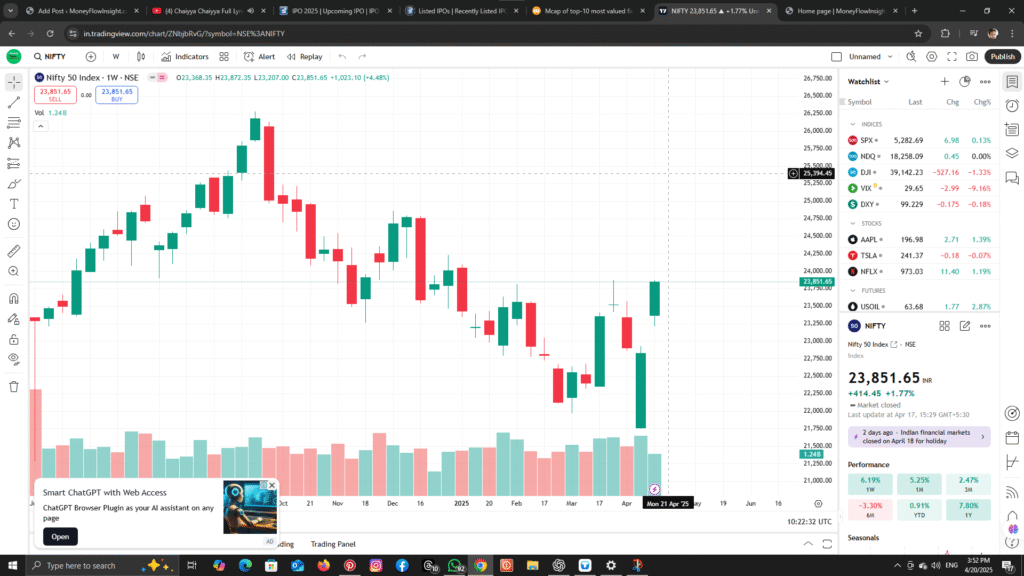

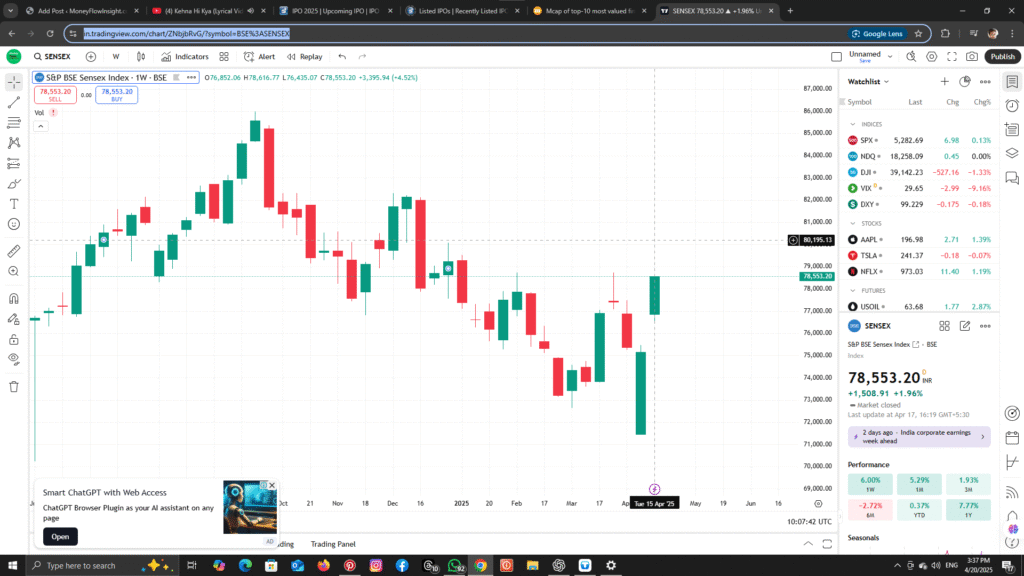

The equity markets in India experienced a robust recovery during the week, fueled by positive domestic and global cues. The S&P BSE Sensex surged by 3,395.94 points , [WEEKLY] marking a 4.51% rise, while the Nifty 50 on the NSE rose by 1,023.1 points, an increase of 4.48%. This market surge was driven by favourable news on various fronts, including signs of a potential resolution to global trade tensions, updates on monsoon forecasts, easing inflation, and market participants’ optimism regarding policy rate cuts.

The Major Drivers Behind the Market Cap Surge

- Global Trade Optimism

One of the key factors contributing to the surge in market capitalisation of top firms was the optimism surrounding the global trade situation. Over the past few weeks, there have been concerns about tariffs and their potential to disrupt international trade flows. However, recent developments suggest that tariffs could be delayed, and select products might be exempted from these trade barriers. This raised hopes that the global trade environment could stabilise, mitigating some of the adverse effects that these tariffs had been expected to bring. Market participants responded positively to these developments, anticipating that any negotiations aimed at de-escalating trade tensions would result in favourable outcomes for businesses, especially those reliant on international markets. With these expectations, investors have begun to place bets on companies that are most likely to benefit from improved trade relations. - Monsoon Forecast and Easing Inflation

Another critical factor that supported the market rally was the forecast for a normal monsoon season in India. Agriculture plays a crucial role in the Indian economy, and the success of the monsoon season is directly linked to crop yields, food prices, and rural income. Positive monsoon forecasts provided reassurance to investors, signalling potential growth in the agricultural sector. Additionally, retail inflation showed signs of easing, further boosting market sentiment. Lower inflation can translate into reduced cost pressures for businesses and can also create an environment where the central bank might consider cutting interest rates to stimulate economic growth. Investors began to anticipate a favourable policy response from the Reserve Bank of India (RBI), which could support further market growth. - Strong Corporate Earnings Reports

The rally in equity markets was also fueled by the release of strong quarterly earnings reports from several prominent companies. HDFC Bank, one of India’s largest private-sector lenders, posted excellent financial results, further cementing its position as one of the market’s biggest gainers. Bharti Airtel, the telecom giant, also saw substantial growth in its market value, driven by its strong performance in the highly competitive telecom sector. These corporate earnings reports reaffirmed investor confidence in the long-term prospects of India’s most valuable companies. As corporate India continues to show resilience amid a challenging economic landscape, market participants are more optimistic about future growth, which contributed to the surge in market capitalization.

Leading the Charge: HDFC Bank and Bharti Airtel

Among the top gainers, HDFC Bank and Bharti Airtel stood out as the biggest contributors to the overall market cap surge.

- HDFC Bank

As one of the most valuable companies in India, HDFC Bank has consistently delivered impressive financial results. Its performance during this period was no different, as the bank reported strong growth in key areas such as net profit, loan growth, and asset quality. The bank’s diversified business model, with a strong presence in retail banking, corporate banking, and wealth management, has helped it weather economic challenges and continue on a growth trajectory. HDFC Bank’s ability to maintain its leadership position in India’s banking sector, combined with favorable economic conditions, made it a prime beneficiary of the market rally. The bank’s stock price surged, leading to a significant increase in its market capitalisation. - Bharti Airtel

The telecom sector in India has been transforming, and Bharti Airtel has been at the forefront of this change. With the rise of data consumption and the expansion of 4G networks, Bharti Airtel has seen strong revenue growth, positioning itself as one of India’s top telecom players. Additionally, the company’s strategic investments in digital services, including broadband, mobile payments, and content platforms, have helped diversify its revenue streams. Bharti Airtel’s strong performance was another driving force behind the market rally, as investors were optimistic about the company’s future prospects in a rapidly evolving telecom landscape. As a result, Bharti Airtel saw its stock price surge, contributing to a significant rise in its market cap. Bharti Airtel

The BSE Sensex and NSE Nifty Surge

The stock market rally was not limited to the performance of individual companies but was a broader trend that impacted the entire market. The Sensex and Nifty, two of India’s most important stock market indices, both witnessed strong gains during the week.

The BSE Sensex, India’s benchmark index, rose by 3,395.94 points, marking an increase of 4.51%. Similarly, the NSE Nifty gained 1,023.1 points, a 4.48% rise. These significant gains in the broader market index reflected the overall positive sentiment prevailing in the equity markets.

Conclusion

The combined Market Cap of India’s top-10 most valued firms has soared by ₹3.84 lakh crore, largely driven by a robust rally in the equity markets. The rally was fueled by optimism surrounding global trade, favorable monsoon forecasts, easing inflation, and strong corporate earnings reports. HDFC Bank and Bharti Airtel emerged as the biggest gainers, leading the charge in this market surge. As investors continue to react positively to these developments, the outlook for India’s equity markets remains optimistic, with hopes for continued growth in the coming months.

This surge in market capitalization not only reflects the resilience of India’s leading companies but also underscores the potential for future growth in the country’s economy, despite global challenges.

Disclaimer:

The views and investment tips expressed by investment experts on MoneyFlowInsight.com are their own and not those of the website or its management. MoneyFlowInsight.com advises users to check with certified experts before taking any investment decisions.

One thought on “Surge in Market Cap of Top-10 Firms: HDFC Bank and Bharti Airtel Lead the Charge”