Introduction

After a brief period of turmoil triggered by Donald Trump’s renewed tariff threats, Indian stock markets made an impressive comeback. In a single trading session, benchmark indices Sensex and Nifty surged more than 2%, adding a whopping ₹11 lakh crore to investor wealth. The recovery was led by easing global trade tensions, strong foreign investor inflows, and positive signals from global markets. This sharp bounce-back not only restored investor confidence but also highlighted the underlying strength and resilience of the Indian economy in the face of geopolitical uncertainty. Here’s a breakdown of what caused the panic, how the markets recovered, and what investors should keep in mind moving forward.

What Triggered the Market Fall?

Trump’s Tariff Threats Rattle Global Markets

Former U.S. President Donald Trump recently suggested that if re-elected, he would reimpose tariffs on Chinese goods. This raised fresh concerns about a possible re-escalation of the U.S.–China trade war, sending shockwaves through global financial markets. Indian equities were not spared, with key indices declining and high volatility observed, especially in export-driven sectors such as IT, auto, and textiles.

Exporters and IT Stocks Take a Hit

The immediate impact was visible in the IT and automobile sectors, where fears of reduced global demand led to sharp selling. Investors, wary of uncertainty, pulled out funds, causing a temporary correction across the broader market.

Markets Bounce Back: A Powerful Rally

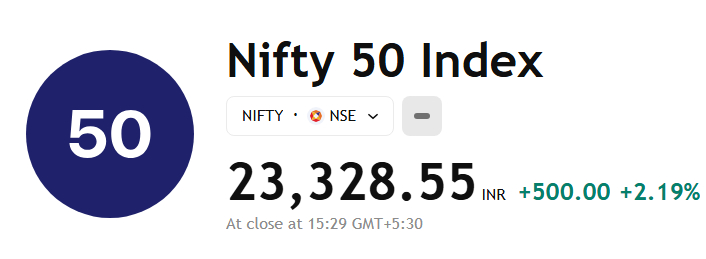

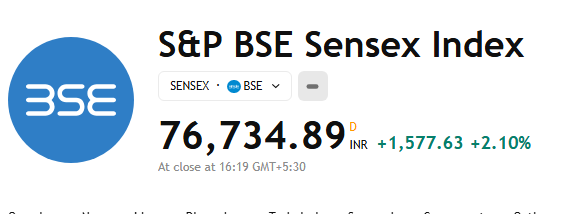

Sensex and Nifty Gain Over 2%

Relief came just as quickly. Reassurances from the U.S. administration that no immediate action would follow Trump’s statements helped calm nerves. Indian markets responded with a strong rally — the Sensex jumped over 1,400 points, and the Nifty gained more than 400 points in a single day.

All-Round Buying from Investors

Almost all sectors participated in the rally. Banking, IT, and auto stocks led the charge as investors returned with renewed confidence. Analysts believe this was a classic case of panic followed by rational buying, especially among long-term investors.

Rs 11 Lakh Crore Wealth Created in One Day

According to data from the Bombay Stock Exchange (BSE), the total market capitalization of listed companies rose by nearly ₹11 lakh crore during the market rebound. This remarkable recovery restored investor wealth that had been temporarily eroded during the initial fall.

For both institutional and retail investors, this was a reminder that market corrections often offer golden opportunities for entry or accumulation.

Top Gainers That Drove the Market Surge

- Reliance Industries – Strong bounce on back of domestic demand recovery

- HDFC Bank & ICICI Bank – Led banking sector’s revival with positive credit growth outlook

- Infosys & TCS – Gained after tech stocks stabilized

- Maruti Suzuki & Tata Motors – Recovered as trade fears eased

These heavyweight stocks not only led the rally but also boosted overall investor sentiment across the board.

RELATED NEWS

Market Soars Over 2%: US Tariff Exemptions Boost Sensex, Nifty

Global Factors Played a Supporting Role

The Indian stock market rally didn’t happen in isolation. Global cues, especially from the U.S., supported the recovery. Wall Street posted gains after calming commentary from U.S. policymakers, while Asian peers like the Hang Seng and Nikkei followed with similar momentum.

Lower crude oil prices and a slightly weaker dollar also acted as tailwinds for Indian equities, especially as they help reduce the pressure on the Indian rupee and inflation.

What Should Investors Do Now?

Expert Advice: Stay Invested, Stay Calm

Market analysts advise investors to not get swayed by short-term geopolitical noise. Here are a few golden rules they suggest:

- Stick to quality large-cap and fundamentally strong stocks

- Use corrections as buying opportunities

- Don’t panic sell during news-driven volatility

- Maintain a long-term view, especially in a growing economy like India

Conclusion

The Indian stock markets has once again showcased its resilience by bouncing back sharply after a brief scare. With ₹11 lakh crore added to investor wealth in just one day, this rally reaffirmed faith in India’s economic and financial strength. While global uncertainties may continue to spark short-term jitters, the long-term growth story remains intact. Smart investors who remain patient and focused will likely reap the rewards in the years to come.

Disclaimer:

The views and investment tips expressed by investment experts on MoneyFlowInsight.com are their own and not those of the website or its management. MoneyFlowInsight.com advises users to check with certified experts before taking any investment decisions.

One thought on “Indian Markets Rebound Strongly After Trump Tariff Shock; Investors Gain Rs 11 Lakh Crore”