Introduction

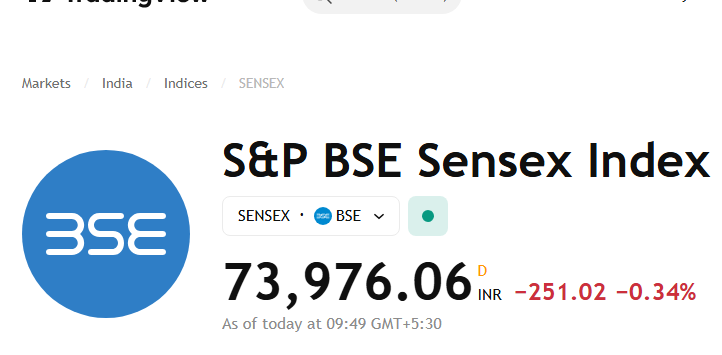

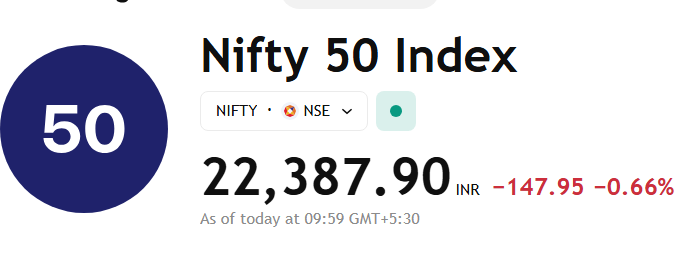

Indian stock markets witnessed a sharp fall on April 9 as Nifty 50 slipped below the crucial 22,400 mark and Sensex dropped over 440 points, dragged by global uncertainties. The sell-off was triggered after US President Donald Trump imposed a massive 104% tariff on Chinese goods, escalating tensions and reviving fears of a full-blown trade war. The ripple effects of this geopolitical move rattled investor sentiment across the globe. Nifty

Adding to the volatility, investors await the RBI Monetary Policy Committee’s decision amid hopes of a 25 bps rate cut. Meanwhile, weekly expiry and heavy call writing at higher levels signaled a bearish trend for the Nifty. Sectors like pharma, metal, and IT bore the brunt of the sell-off while FMCG stocks showed some resilience.

Recent news

Trump’s 104% Tariff on China Triggers Global Market Jitters

Global Tensions Drag Markets Lower

U.S.-China Trade War Escalates

A surprise move by President Trump to slap a 104% tariff on Chinese imports has reignited trade war fears. In retaliation, China announced a 34% tariff on all American imports. If the situation intensifies further, markets could be in for a prolonged period of volatility.

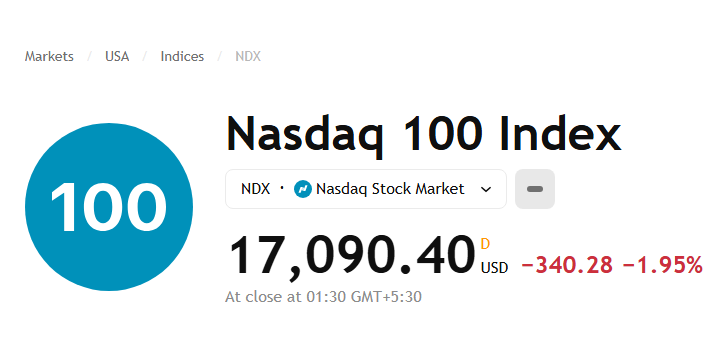

Global markets reacted sharply:

- S&P 500 breached the 5,000 mark and is now down nearly 19% from its peak.

- Nasdaq fell 2.5%, while Dow Jones dropped 0.8%.

- Asian markets followed suit, with Nikkei 225 falling 3%, and Hong Kong’s Hang Seng Index tumbling 2%.

Indian Markets Mirror Global Weakness

Nifty and Sensex Drop Sharply

At opening bell;

Nearly all sectoral indices traded in the red except for FMCG, as investors sought defensive plays.

Broader Market Takes a Hit

- Nifty Midcap 100 and Smallcap 100 fell 0.6% each

- Declining stocks outnumbered advancing ones by a huge margin

RBI Policy Decision in Focus

Rate Cut Expectations

The RBI Governor Sanjay Malhotra is expected to announce a 25 basis points cut at 10 AM, as inflation cools and global growth slows. A dovish stance may offer short-term relief to equity markets.

“With moderating inflation and growing global headwinds, the RBI has room for an accommodative stance,” said Devarsh Vakil, Head of Prime Research, HDFC Securities. Nifty

Sectoral Breakdown: Who’s Bleeding the Most?

Pharma Stocks Hit Hard

Pharma index dropped 2% after Trump reiterated his plan to impose steep tariffs on pharmaceutical imports, aiming to reshore drug production.

Metals and IT Decline Sharply

- Metal stocks fell 1.5% amid trade war fears.

- IT stocks declined due to expected reductions in outsourcing orders if the global economy weakens.

Derivatives Data Points to Bearish Trend

Heavy Call Writing Seen at 23,500 Level

According to the weekly options data:

- 23,500 strike has the highest Call OI (1.22 crore contracts)

- Followed by 23,000 and 23,300 strikes

This indicates strong resistance and lack of bullish conviction in the near term.

“Persistent call writing at higher strikes shows bearish expectations,” noted Dhupesh Dhameja of SAMCO Securities. Nifty

Expert Opinion: India Still a Bright Spot

Despite global turmoil, some experts remain positive on India’s long-term trajectory.

“India has been an outperformer during this global sell-off. We expect this outperformance to continue, supported by strong domestic fundamentals,” said K. Vijayakumar, CIO, Geojit Financial.

Conclusion: Brace for More Volatility

With Trump’s tariff shock triggering a risk-off mood globally and the RBI policy meeting on the horizon, investors should be prepared for heightened volatility. While India’s fundamentals remain strong, short-term market direction may be dictated by global cues and derivatives data.

Traders are advised to remain cautious, limit leverage, and track the RBI decision closely.

Disclaimer

The content published on Money Flow Insight is for informational and educational purposes only. It does not constitute financial advice or investment recommendations. All investment and trading decisions should be made after conducting proper research and consulting a certified financial advisor. Money Flow Insight and its contributors are not responsible for any financial losses or damages incurred as a result of using the information provided in this article.

2 thoughts on “Nifty Falls Below 22,400 as Trump’s 104% Tariff Sparks Sell-Off”