U.S. Tech & Retail Stocks Lead Market Selloff Amid Trump’s Tariff Shock

Introduction

The Dow Jones Industrial Average dropped 2.72%, while the S&P 500 lost 3.21%, marking one of the worst trading sessions in months. With the new baseline tariff of 10% on all imports and increased duties on multiple nations, analysts predict potential economic slowdowns and higher recession risks.

Tech Giants Take a Hit as Market Reels

Apple, Amazon, and Semiconductor Stocks Decline

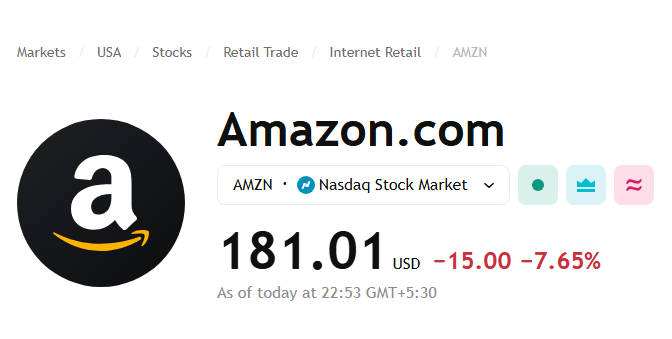

Apple saw its shares tumble by 9%, reflecting concerns over rising costs and supply chain disruptions. Amazon followed closely with a 7% drop, as higher tariffs could drive up prices and reduce consumer demand. The technology sector, particularly semiconductor companies that rely on Asian manufacturers, also suffered significant losses.

The U.S. stock market faced a sharp decline as President Donald Trump announced sweeping new tariffs, sending shockwaves across industries. Tech giants like Apple and Amazon, along with retail powerhouses such as Walmart and Nike, bore the brunt of the selloff. Investors scrambled to assess the long-term impact of these tariffs, which threaten global supply chains and corporate profitability.

- Increased Production Costs: Many tech firms manufacture their products in Asia. The higher tariffs mean increased expenses, which may be passed on to consumers.

- Supply Chain Disruptions: The potential for retaliatory tariffs from key manufacturing hubs like China could further strain the industry.

- Investor Panic: The uncertainty surrounding long-term trade policies has led to a massive selloff.

Why Are Tech Stocks Falling?

Retail Giants Struggle with Cost Inflation

Walmart and Nike Brace for Impact

Retailers, already dealing with inflation and changing consumer habits, now face additional challenges. Walmart and Nike stocks fell sharply, reflecting concerns over rising costs for imported goods and weaker consumer spending power.

How Tariffs Hurt Retailers

- Higher Import Prices: Tariffs on clothing, footwear, and electronics will make goods more expensive.

- Lower Consumer Demand: As prices rise, consumers may cut back on spending, impacting revenue.

- Profit Margin Squeeze: Retailers might struggle to absorb costs without significantly raising prices.

The Economic Ripple Effect of Tariffs

Potential for a U.S. Recession

Deutsche Bank’s Senior U.S. Economist, Brett Ryan, cautioned that the new tariffs could shave 1 to 1.5 percentage points off U.S. economic growth this year. This raises fears of a potential recession, as businesses navigate higher operational costs and declining profits.

Industries Most at Risk

- Automotive: Increased costs for parts and materials could slow vehicle production.

- Consumer Electronics: Companies like Apple and Samsung will have to adjust pricing strategies.

- Retail: A possible decline in discretionary spending could hurt stores reliant on imports.

Market Outlook: What’s Next for Investors?

How Will Stocks Recover?

While the immediate reaction has been negative, analysts suggest that companies might adapt by shifting supply chains, renegotiating supplier contracts, and seeking government relief. Investors are now closely watching potential trade negotiations, Federal Reserve policies, and corporate earnings reports to gauge recovery prospects.

Recent news

Top Market Stocks to Watch on April 2, 2025: Tata Steel, Power Grid, TCPL, Coal India & More

What Should Investors Do?

- Diversify Portfolios: Spreading investments across various sectors can minimize risks.

- Monitor Policy Changes: Keeping an eye on government trade talks can help anticipate market moves.

- Focus on Resilient Stocks: Companies with strong balance sheets and domestic operations may perform better in uncertain times.

Conclusion

The latest tariff announcement by President Trump has rattled financial U.S. stock markets, with tech and retail stocks leading the downturn. While uncertainty looms, businesses and investors will need to adapt to shifting trade policies and market conditions. The coming weeks will be crucial in determining whether the U.S. economy can withstand these new challenges or if a broader downturn is imminent.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. MoneyFlow Insight is not responsible for any investment decisions based on this content. Always consult a professional before making financial decisions.

2 thoughts on “U.S. Tech & Retail Stocks Plummet After Trump’s Tariff Blow”