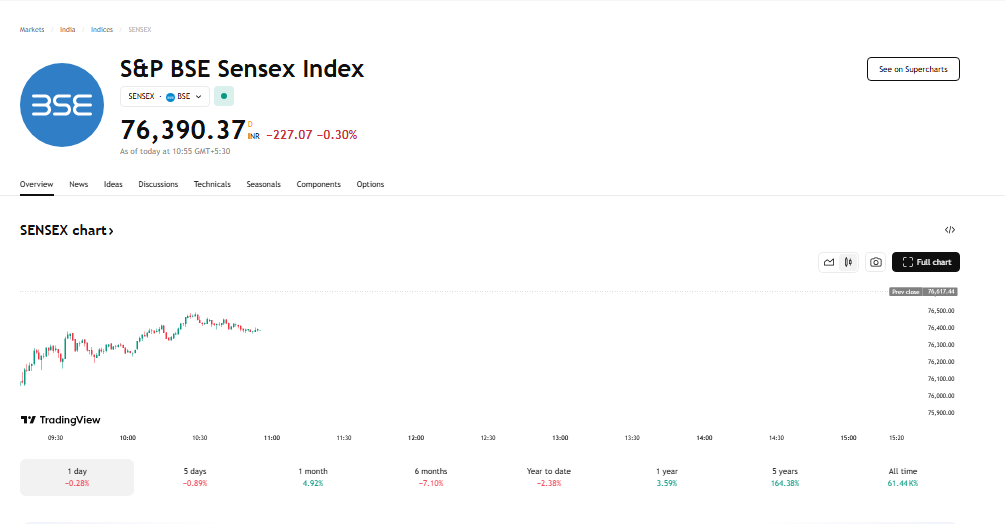

New Delhi: The Indian stock market witnessed a sharp decline on Wednesday as the Sensex plummeted by over 500 points, reacting to the sudden announcement by US President Donald Trump regarding a 26% reciprocal tariff on Indian goods. This development has created a ripple effect in the financial markets, triggering investor concerns and impacting currency exchange rates as well.

Market Reaction and Sectoral Impact

The Sensex’s steep drop was accompanied by a decline in the Nifty index, with multiple sectoral indices facing considerable pressure. Market analysts attributed the sharp sell-off to growing investor uncertainty over the implications of this tariff decision.

Among the hardest-hit sectors, Nifty Auto declined by 1.25%, reflecting concerns over increased costs for auto manufacturers that rely on international trade. Nifty IT also suffered a significant fall of 1.67%, as the technology sector is highly sensitive to global trade tensions. Additionally, Nifty Metals dropped by 0.81%, indicating investor apprehensions about the impact on exports and production costs.

However, amid the broader market decline, the pharmaceutical sector emerged as an outlier, registering a gain of 2.95%. Experts suggested that pharma stocks performed well because the newly announced tariffs do not directly impact this sector, allowing investors to shift their focus to safer bets.

Impact on the Indian Rupee

In addition to the stock market turbulence, the Indian rupee also faced downward pressure. The currency weakened by 26 paise to 85.78 against the US dollar in early trading, signaling investor concerns over India’s trade dynamics with the United States.

The fall in the rupee’s value suggests that traders are wary of the economic consequences of the tariff move, as higher import costs and potential disruptions in trade could create inflationary pressures. This depreciation also indicates that foreign investors might be pulling funds out of Indian markets in favor of more stable assets.

Global Market Implications

The shockwaves of Trump’s tariff announcement were not limited to Indian markets. The US futures market also showed signs of distress, with Dow Jones Futures dropping by 1.94% at the time of writing. This indicates a likely weak opening for Wall Street, suggesting that global investors are responding to trade policy uncertainties with heightened caution.

Trade tensions between major economies tend to have widespread consequences. If additional retaliatory measures are introduced by India in response to the US tariffs, it could lead to prolonged uncertainty in global markets. This could potentially trigger further volatility, affecting multinational businesses and investment sentiment.

Investors Seek Safe-Haven Assets

With the equity markets showing signs of stress, investors are increasingly turning to safe-haven assets such as gold. This shift further exacerbates the sell-off in equities as large-scale fund reallocation takes place. Gold prices have shown an upward trend in recent weeks, a classic response to periods of economic uncertainty and geopolitical instability.

Recent news

India’s 5 Key Steel Policy Changes: Boosting Local Production & Fair Competition

Trump Declares ‘Liberation Day’ as New Tariffs Take Effect (2024)

BEL Share Price Falls 5% as Rs 23,000 Crore Turnover Misses Target

5 Key Reasons Bernstein Downgrades Waaree Energies & Premier Energies: Here’s Why

Sensex Crashes 1,500 Points, Nifty Slips Below 23,200 Amid US Tariff Concerns

Expert Opinions and Future Outlook

Market experts remain cautious as they closely monitor further developments in trade policies between India and the US. Analysts suggest that while the current volatility may continue in the short term, long-term market movements will depend on how India responds to the tariff move and whether diplomatic negotiations can ease tensions.

Some financial strategists believe that the Indian government may explore alternative trade measures or seek exemptions for specific industries to mitigate the impact. Others suggest that the focus should shift to strengthening domestic industries to reduce reliance on exports.

For retail investors, experts advise maintaining a balanced approach by diversifying portfolios and avoiding panic-driven decisions. As geopolitical factors continue to influence market behavior, a well-diversified investment strategy can help navigate the uncertainties ahead.

Conclusion

Trump’s decision to impose a 26% reciprocal tariff on Indian goods has sent shockwaves through the stock market, leading to a sharp decline in the Sensex and Nifty indices. The rupee has also taken a hit, further signaling economic concerns. While the pharma sector has emerged as a resilient player, broader market sentiment remains fragile. Investors and analysts will be keeping a close eye on further developments, hoping for diplomatic resolutions that could ease market tensions and restore confidence in global trade stability.

One thought on “Tariff : Sensex Drops Over 500 Points After Trump Announces 26% Reciprocal Tariff”