Global brokerage firm Bernstein has initiated coverage on Indian solar manufacturers Waaree Energies Ltd and Premier Energies Ltd with an ‘Underperform’ rating. The firm believes these companies face major competitive challenges from industry giants like Reliance and Adani Enterprises, who have extensive backward integration in the solar PV space.

The Growing Competition in Solar PV

Bernstein acknowledges that both Waaree Energies and Premier Energies have made the right strategic investments at the right time. However, in a rapidly evolving industry where financial muscle and integration matter, the brokerage firm believes that these companies may struggle to sustain their high returns.

While Waaree Energies has the potential to scale up and diversify beyond module-cell production, it still faces competition from larger players with deeper pockets. Premier Energies, on the other hand, has a strong cell capacity, but its future growth remains uncertain amid increasing competition and changing regulations.

Key Challenges for Waaree and Premier Energies

Bernstein pointed out several risks that could impact the long-term profitability of these solar manufacturers:

- Declining Returns: The brokerage expects returns for these companies to normalize to teens from the current 40% levels.

- Regulatory Dependence: Both companies heavily rely on import regulations in India and the US, making their profitability vulnerable to policy changes.

- Warranty Risk: The companies provide a 30-year performance warranty on their products, but solar PV modules have not been tested for such a long period.

- Market Saturation: The global solar PV market is facing an oversupply crisis, with manufacturing capacity exceeding demand by more than 100%.

Global Solar PV Market Faces Overcapacity

Bernstein highlighted a concerning trend in the global solar PV industry—an oversupply crisis. The total manufacturing capacity worldwide has crossed 1,200 GW, while the demand remains around 600 GW.

The US, which shifted away from Chinese solar imports, saw Indian PV exports rise from $0.1 billion in FY22 to $2 billion in FY24. However, with the US now having 52 GW of installed module manufacturing capacity and another 19 GW under construction, the excess supply could put downward pressure on prices.

The short commissioning timeline (1-2 years) and low capital expenditure make this industry prone to oversupply, which could lead to shrinking margins for Waaree and Premier in the coming years.

Stock Ratings and Price Targets

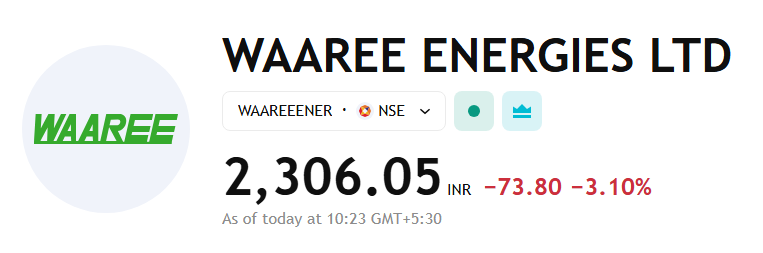

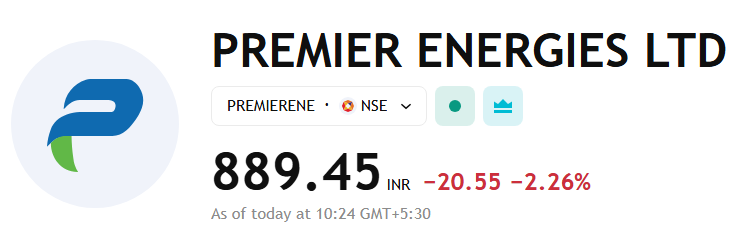

Based on these factors, Bernstein has initiated coverage on Waaree Energies and Premier Energies with an ‘Underperform’ rating, setting price targets as follows:

- Waaree Energies: Rs 1,902 (21% downside)

- Premier Energies: Rs 693 (26% downside)

Among the two, Bernstein favors Waaree Energies due to its potential for backward integration into ingot-wafer production and a strong international order book that provides better revenue visibility.

also read :- Sensex Crashes 1,500 Points, Nifty Slips Below 23,200 Amid US Tariff Concerns

What Lies Ahead?

Despite the challenges, Bernstein acknowledges that the solar PV sector is an essential part of India’s renewable energy ambitions. The Indian government continues to push for domestic manufacturing, and large conglomerates are eyeing an entry into this space.

Bernstein believes that energy transition investments will increase, and more companies will enter the public market. However, given the current cycle and expected return deterioration, it remains cautious about investing in these stocks at current valuations.

Final Thoughts

Waaree Energies and Premier Energies have done well to establish themselves in the Indian solar manufacturing industry. However, stiff competition from bigger players, regulatory risks, and an oversupply in the global market could pressure their margins and growth prospects.

While Waaree Energies has a slight edge over Premier Energies due to its long-term strategy, both companies face an uncertain future in an industry where scale and financial strength matter the most. Investors should consider these factors before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Readers should consult a qualified financial advisor before making any investment decisions.

2 thoughts on “5 Key Reasons Bernstein Downgrades Waaree Energies & Premier Energies: Here’s Why”