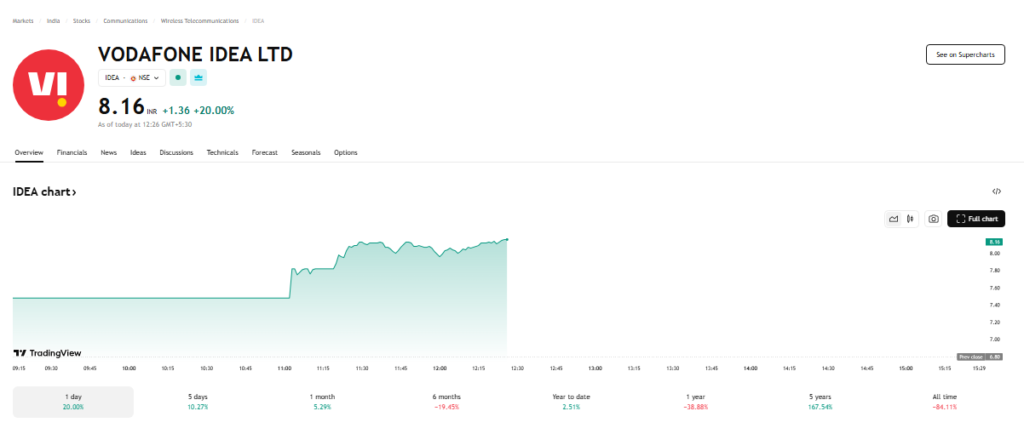

Vodafone Idea Shares Surge 15% as Government Converts Dues into Equity witnessed a significant rally in its stock price on April 1, 2025, surging 15% after the company announced that the Government of India (GoI) would convert Rs 36,950 crore of outstanding spectrum dues into equity. With this conversion, the government’s stake in VI will increase from 22.6% to 48.99%, making it the largest shareholder in the telecom operator.

Government Converts Rs 36,950 Crore Dues into Equity

The Ministry of Communications issued an order on March 29, 2025, approving the conversion as part of the Telecom Reforms Package announced in September 2021. Vodafone Idea received the official order on March 30. The share issue price was calculated based on the volume-weighted average price over the past 90 trading days or the preceding 10 days before the relevant date (February 26, 2025), in compliance with the Companies Act, 2013.

This marks the second instance of the government converting Vodafone Idea’s debt into equity. Previously, in 2023, the GoI had converted Rs 16,133 crore of debt into equity at Rs 10 per share.

Stock Market Reaction to Government Equity Conversion

Following the announcement,VI shares surged by 15% in intra-day trade. The positive sentiment also boosted Indus Towers, which saw a 7% increase in its stock price. Investors reacted positively to the financial relief provided by the government’s intervention, although long-term concerns regarding the company’s stability remain.

Citi Research Maintains Buy Rating on Vodafone Idea

International brokerage firm Citi Research reaffirmed its buy rating on Vodafone Idea, maintaining its target price at Rs 12 per share. This implies a potential upside of around 76% from the previous session’s closing price. Citi highlighted that while the equity conversion eases Vodafone Idea’s immediate financial burden, the telecom company still needs to secure fresh funds to expand its 4G and 5G networks.

Motilal Oswal Raises Vodafone Idea’s Target Price

Domestic brokerage firm Motilal Oswal also responded to the development by revising its target price for VI shares to Rs 6.5 per share, up from Rs 5 earlier. The firm noted that the government’s equity conversion is a key medium-term positive, as it provides cash flow relief. However, it also emphasized the importance of stabilizing Vodafone Idea’s subscriber base, raising long-pending debt, and seeking additional relief on adjusted gross revenue (AGR) dues.

Motilal Oswal further stated that the government’s commitment to maintaining a 3+1 market structure in the Indian telecom sector and the easing of VI cash flow constraints are also positive signs for Indus Towers, which relies on Vi as a major customer.

Vodafone Idea’s Financial Struggles and Future Challenges

Despite the stock rally and financial relief from the government,VI continues to face significant financial hurdles. The telecom operator has struggled with declining market share, debt repayment issues, and the urgent need to raise fresh capital to stay competitive in the Indian telecom industry. The company’s inability to expand its 4G and 5G infrastructure due to a lack of funds has put it at a disadvantage compared to rivals Reliance Jio and Bharti Airtel.

Additionally, Vodafone Idea shares have lost over 50% of their value in the past year, reflecting investor concerns over its long-term sustainability and growth prospects. While the government’s intervention provides temporary relief, Vodafone Idea still needs to secure additional funding, enhance its service offerings, and improve customer retention to remain viable.

Conclusion: High-Risk, High-Reward Investment

Market analysts continue to view Vodafone Idea as a high-risk, high-reward investment. While the government’s decision to convert dues into equity provides some breathing space, the telecom operator must address fundamental challenges such as fundraising, network expansion, and subscriber retention.

For investors, Vodafone Idea remains a volatile stock. The recent developments indicate some optimism, but the company’s ability to execute a long-term turnaround strategy will ultimately determine its success in the Indian telecom market.

Recent news –Social Security Payments: Up to $5,180 for Retirees and Vulnerable Americans This Week

Disclaimer: The information in this article is for informational purposes only and does not constitute financial advice. Investors should consult certified professionals before making any investment decisions.

One thought on “Vodafone Idea Shares Surge 15% as Government Converts Dues into Equity”