Indian Renewable Energy Development Agency (IREDA) shares are set to be in focus today after a significant rally in the previous session. The stock surged nearly 10% on Monday, March 24, ahead of the company’s board meeting scheduled for today, March 25, 2025. Investors are closely watching the stock as the board is expected to discuss and approve the borrowing plan for FY26, which could impact IREDA’s financial strategy and stock movement.

IREDA Board Meeting: Key Agenda

Borrowing Plan for FY26

IREDA announced that its board of directors will meet on March 25 to discuss its borrowing plan for the financial year 2025-26. According to the company’s regulatory filing on March 20, the agenda includes plans for raising funds through various instruments, including taxable bonds, subordinated Tier-II bonds, and external commercial borrowings (ECB).

This meeting comes at a crucial time as IREDA seeks to expand its financial resources to support renewable energy projects across India. Investors anticipate significant announcements regarding fundraising strategies, which could impact the company’s future growth trajectory.

Previous Borrowing Enhancement

On March 17, IREDA’s board approved an increase in the borrowing program for FY25 by ₹5,000 crore, taking the total borrowing limit to ₹29,200 crore. This enhancement is aimed at strengthening the company’s financial position and funding new renewable energy projects.

The borrowing plan includes:

- Taxable Bonds/Subordinated Tier-II Bonds/Perpetual Debt Instruments (PDI)

- Term loans from banks and financial institutions

- Credit lines from international agencies (multilateral and bilateral)

- External Commercial Borrowings (ECB)

- Short-term loans & working capital demand loans (WCDL)

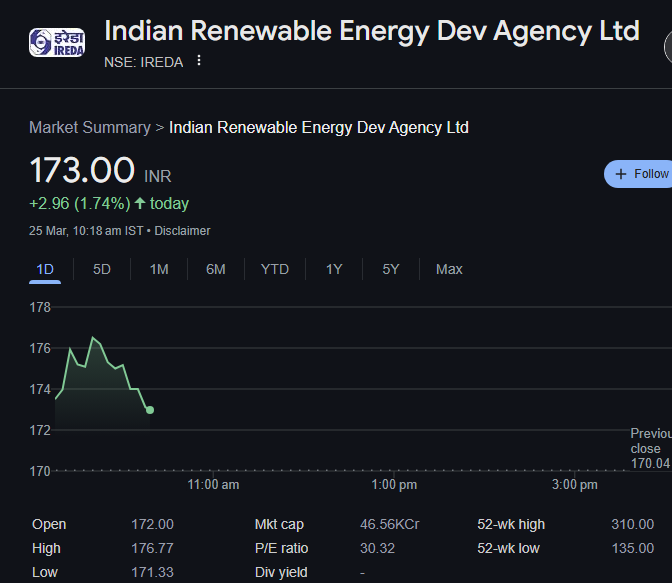

IREDA Share Price Performance

Recent Market Trends

IREDA shares has experienced significant volatility in recent months. While the stock surged nearly 10% in the last session, its overall trend has been bearish. Here’s a quick look at the stock’s performance:

- 1-month performance: Down 21%

- Year-to-date (YTD) performance: Down 37%

- 6-month performance: Down 40%

- 1-year performance: Up 10%

Despite the recent downtrend, Monday’s rally signals renewed investor interest ahead of the board meeting, indicating possible positive developments in the borrowing plan or other financial strategies.

What’s Driving IREDA’s Stock Movements?

Several factors have influenced IREDA’s stock price in recent months:

- Funding Plans – Investors react positively to fundraising activities that strengthen the company’s ability to finance renewable energy projects.

- Government Policies – Supportive policies for the renewable energy sector can impact IREDA’s growth prospects.

- Market Sentiment – Broader market trends and investor sentiment in the renewable energy space influence stock performance.

Outlook for IREDA Stock

Can IREDA Rebound from Its Recent Decline?

While IREDA stock has faced a sharp decline in recent months, positive developments from today’s board meeting could provide a much-needed boost. If the company successfully secures additional funding and outlines a strong growth strategy, investor confidence may improve, leading to a potential stock price recovery.

Factors to Watch

Investors should keep an eye on the following factors:

- Outcome of today’s board meeting

- Details on the borrowing plan for FY26

- Government initiatives supporting renewable energy

- Quarterly financial performance and revenue growth

Related News: IREDA Stock Correction: 53% Fall from Record High Brings RSI into Oversold Zone

Conclusion

IREDA shares are in the spotlight today as the company’s board meets to discuss its borrowing plan for FY26. After a sharp rally of nearly 10% on Monday, investors are eagerly awaiting key announcements that could impact the company’s future growth and stock performance. While the stock has faced significant declines in recent months, positive developments from the board meeting could provide an opportunity for recovery. Investors should closely monitor updates from the meeting to make informed investment decisions.

FAQs

1. Why are IREDA shares in focus today?

IREDA shares are in focus as the company’s board meets today to discuss and approve its borrowing plan for FY26. Investors are anticipating key announcements that could impact the company’s financial strategy.

2. How has IREDA’s stock performed recently?

IREDA shares have been on a downward trend, declining 21% in the past month and 37% year-to-date. However, the stock gained nearly 10% in the last session ahead of today’s board meeting.

3. What was IREDA’s recent borrowing program enhancement?

On March 17, IREDA’s board approved an increase in the borrowing program for FY25 by ₹5,000 crore, taking the total borrowing limit to ₹29,200 crore.

4. Will IREDA’s stock price recover?

IREDA’s stock recovery depends on the outcome of today’s board meeting and investor sentiment. If the borrowing plan is well-received and the company outlines strong growth strategies, the stock may see an upward trend.

5. What are the key factors influencing IREDA’s stock?

Key factors include fundraising activities, government policies on renewable energy, market sentiment, and the company’s financial performance.

One thought on “IREDA Shares in Focus: 5 Key Updates Ahead of Board Meeting:”