RBL Bank Stock Rallies 5%; Bullish Breakout Signals More Upside Ahead

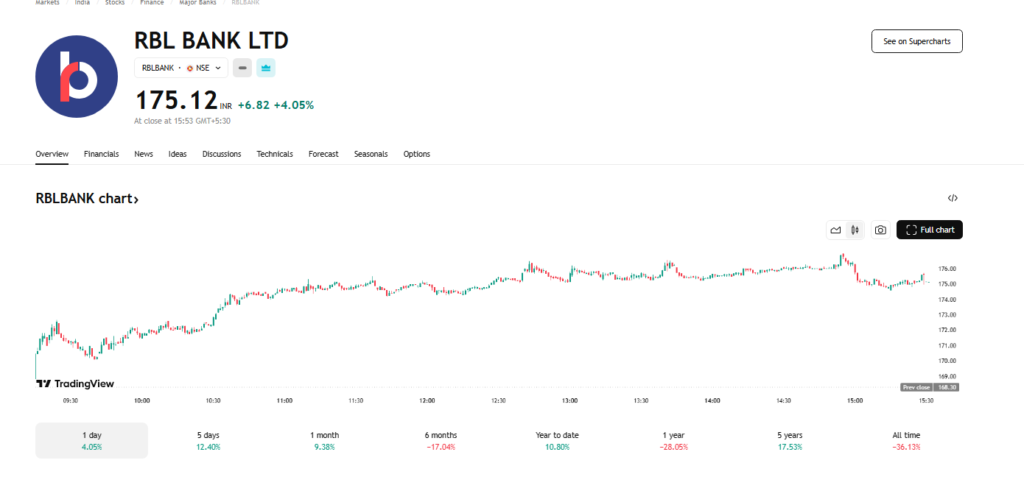

Shares of RBL Bank Ltd surged nearly 5% on Monday, hitting an intraday high of ₹176.40, as the broader banking sector witnessed strong buying interest. The rally comes after Anand Rathi Share and Stock Brokers issued a bullish outlook, projecting a target price of ₹204 over the next 1–3 months. The brokerage highlighted a significant technical breakout above the ₹170–150 consolidation range, driven by strong trading volumes and rising momentum indicators.

RBL Bank: Technical Breakout Sparks Bullish Momentum

Stock Breaks Out of Consolidation Range

According to Anand Rathi, RBL Bank had been trading in a narrow range of ₹150–170, showing limited price movement in recent sessions. However, Monday’s session marked a decisive breakout, with prices closing significantly above the upper resistance zone. The Relative Strength Index (RSI) has crossed 60, indicating strengthening bullish momentum and a potential uptrend continuation.

Analyst Recommendation and Trading Strategy

The brokerage has advised traders to accumulate the stock in the ₹173–167 range, while maintaining a stop-loss at ₹155 to manage downside risks. The upside target remains at ₹204 within 1–3 months, supported by both technical and fundamental factors.

Fundamental View: Mixed Earnings, But Optimistic Outlook

Earnings Hit by Provisions

Despite the stock’s bullish technical setup, fundamentals showed mixed signals. RBL Bank reported a net profit of just ₹3.26 crore in Q3FY24, a steep fall from ₹230 crore YoY, mainly due to higher provisions. However, analysts remain optimistic about a recovery in profitability in the upcoming quarters.

Asset Quality: Mixed Signals But Signs of Stability

- Gross NPA rose to 2.92% from 2.88% YoY, indicating a slight deterioration.

- Net NPA improved to 0.53% from 0.79%, signaling better control over bad loans.

- Risk segments like credit cards and microfinance continue to pose challenges, but overall asset quality remains manageable.

Loan Growth and Slippages Outlook

Although loan growth guidance was revised to low double digits, RBL Bank had previously shown YoY growth of 19.66%, well above its 5-year CAGR of 7.68%. Analysts believe slippages have peaked, particularly in the Joint Liability Group (JLG) segment, and expect improved collection efficiency going forward.

Arihant Stock Broking Also Positive on Recovery Path

Cost-to-Asset Ratio to Improve Profitability

Arihant Stock Broking echoed positive sentiment, stating that RBL Bank’s cost-to-asset ratio is expected to improve, thereby boosting future profitability. The brokerage believes that slippages in JLG segment have peaked, and Q4FY25 could reflect better financial performance.

Stable NIMs and Improving Collections

The Net Interest Margin (NIM) is expected to stay within 4.7–4.9%, supported by lower disbursements in the JLG segment. States such as Maharashtra, Punjab, Bihar, and Rajasthan have seen significant improvements in collection efficiency, reinforcing confidence in the bank’s recovery trajectory.

Here the related news Share Price Jumps 15% in One Month: Will It Break Above ₹300 Soon

Persistent FII Outflows: Why Foreign Investors Are Selling Indian Stocks

Conclusion: Technical and Fundamental Triggers Support Bullish Sentiment

With a strong technical breakout, improving collection efficiency, and optimistic forward guidance, RBL Bank shares appear poised for a potential rally. While short-term earnings were impacted by provisioning, analysts see long-term value emerging, with a target price of ₹204 in sight. For investors seeking mid-term opportunities in the banking sector, RBL Bank presents a compelling case backed by technical strength and recovering fundamentals.

FAQs:

Q1. Why did RBL Bank shares rise 5% today?

RBL Bank shares rose due to a bullish breakout above the ₹170 resistance, strong trading volumes, and a positive outlook from brokerages like Anand Rathi.

Q2. What is Anand Rathi’s target for RBL bank?

Anand Rathi has set a target price of ₹204 for RBL Bank stock over the next 1–3 months.

Q3. What are the key risks to RBL bank growth?

The main concerns include asset quality risks in segments like microfinance and credit cards, and slower profit growth due to higher provisions.

Q4. What is the recommended buy range for RBL Bank stock?

Analysts suggest buying in the ₹173–167 range, with a stop-loss at ₹155 to manage downside risk.

Q5. Is RBL a good buy now?

Yes, based on technical indicators and improving fundamentals, RBL Bank is considered a good short to medium-term buy by leading brokerages.